While Credit Karma boasts its free credit score to anyone who wants it the company provides access to an individuals VantageScore 30 not the FICO Score that the majority of lenders use to evaluate an individual. In the credit industry these credit scores are referred to as FAKOs.

How To Get Your Credit Score For Free

If my eq was a 676 my tu cant be anywhere near a 740 could it is this credit karma just a bunch of.

How close is credit karma score to mortgage score. Here are three of the reasons why. Length of credit history 15. VantageScore was created in collaboration with all three credit.

Like WalletHub Credit Karma is an independent website that among many other features gives users free access to their Vantage 30 credit score. When you make an application for a mortgage or other type of credit lenders work out a credit score for you. 8122018 Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender.

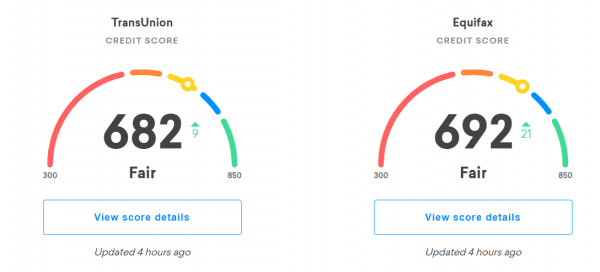

Other times the opposite might be true. 1132021 The free credit score you receive from Credit Karma comes straight from TransUnion and Equifax two of the three credit bureaus. 5252020 For the best results you should try to keep this ratio under 30 whenever possible.

When I stared rebuilding my credit karma score never budged but my other scores including other fako scores did move. The Vantage algorithm being used by Credit Karma is typically 50 points or higher than a mortgage FICO score Now. This is to help them decide if they think youll be a risk worth taking - if youll be a responsible reliable borrower and likely to repay the debt.

There isnt a specific credit score you need for a mortgage and thats because there isnt just one credit score. Beacon 50 Classic04 FICO V2. Credit Karma compiles its own VantageScore based on that.

Only hard inquiries such as a lenders credit check when you apply for a mortgage get reported. This means a couple of things. EQ- 576 TU- 589 EX- 567 3715 Scores.

I learned that my credit karma score was about sixty points lower than the lender scores. 3192021 If you try to apply for a home loan through a bank or credit union they will often require that your score be 660 or above. EQ- 666 TU- 680 EX- 669 last app 31115 Message 9 of 10.

I dont want to spend 15 bucks to check the tu but there is no way this is accurate. While you cant really do. Credit Karma and FICO are two completely different types of companies.

If your credit score falls below that you can still get a mortgage. 4122021 Credit Karma creates a VantageScore based on TransUnion and Equifax information. When you check your credit score on Credit Karma it counts as a soft inquiry that is not sent to the credit bureaus.

It is not your FICO score the scoring model used by the vast majority of lenders. The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax two of the three major consumer credit bureaus. But if you apply through a mortgage broker you may have an easier time qualifying since many lenders are willing to offer customers loans who have credit scores below 660.

Why Is My Credit Karma Score Different From My FICO Score. 262016 John S Kiernan Managing EditorFeb 6 2016. Score and it pulled up i had a 740.

Your Credit Karma score could be much lower than your FICO score. Its a benchmark but it isnt the number used by most lenders when making loan decisions. 2242020 To qualify for a low down payment mortgage currently 35 youll need a minimum FICO score of 580.

10242019 Whether its a different score from a bank an auto lender or another source its not unusual to see many different credit scores. There are many different scoring models. Now I have never checked my tu this month but my eq score is a 676.

1212019 There are reports of people with Credit Karma scores over 700 with both bureaus but with FICO scores in the lower 600s. Ok so I tried out the credit karma fako. 5202019 Credit Karma utilizes a Vantage scoring model while the mortgage industry utilizes three FICO algorithms.

On Credit Karma youll see scores and reports from TransUnion and Equifax both using the VantageScore 30 scoring model. 11102020 Heres the short answer. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

The scores and credit report information on Credit Karma come from TransUnion and Equifax two of the three major credit bureaus. For example you could receive a loan of 6000 with an interest rate of 799 and a 500 origination fee of 300 for an APR of 1151. Article continues below.

The nice thing about Credit Karma updating the score every 7 days is that it allows you to keep a close eye on your score and the changes. You will see your current score and the update from past weeks months and more. With the weekly updates that Credit Karma offers you have a great opportunity to spot any potential problems before they arise.