12102020 Is Credit Karma safe to use. They use 128-bit encryption to protect data transmission which is almost impossible to crack.

Why Is My Credit Karma Score Lower Or Higher Than My Mortgage Lender The Home Mortgage Pro Blog Credit Karma Home Mortgage Mortgage Lenders

2272020 Lenders use scores from all three credit bureaus If an applicants credit file is too thin an underwriter might decide a mortgage isnt even a possibility Glutz explained.

Do mortgage lenders use credit karma. How to contact Credit Karma. 3142012 As I am currently applying for a mortgage I compared the lender reported credit score 744 with those available from the account management companies such as Credit Karma. No delinquency on rental payments.

Where is the Credit Karma login. Credit Karma is a credit broker not a lender. Credit Karmas business model is to earn advertising revenue and commissions from loans you get through the site.

9262020 Mortgage lenders use a score developed specifically for mortgage loans. 3252021 With the exception of the mortgage market which is heavily regulated lenders can generally choose which FICO score they use when doing a credit check. CREDIT KARMA OFFERS INC.

162017 The CFPB recently sanctioned TransUnion and Equifax for misleading consumers about the credit scores lenders actually use to make lending. You can find the Credit Karma login in the upper right-hand corner of the home page. But Canadian consumers cannot access their FICO score on their own.

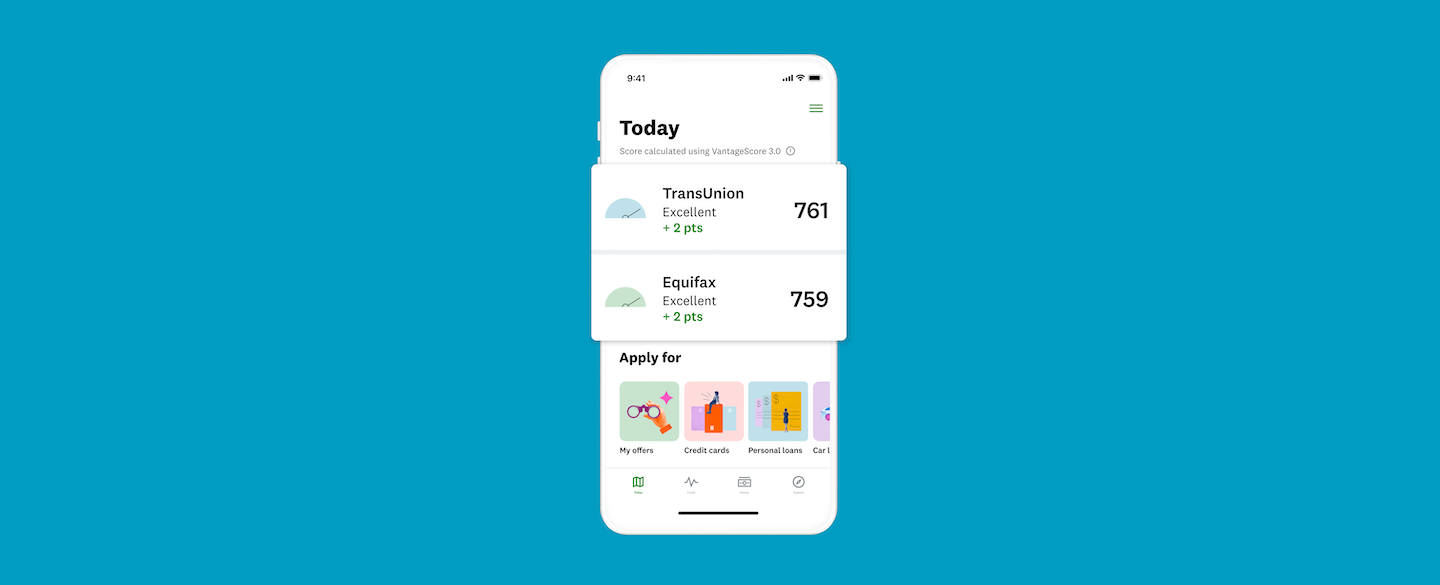

732020 FICO says 90 of Canadian lenders use it including major banks. 1072020 This is the credit score lenders use when you apply for a mortgage Mortgage lenders use a unique version of your FICO score to evaluate creditworthiness. Stepping on the property ladder in the near future.

Here is how you can reach Credit Karma. 182020 FHA loans allow lenders to use nontraditional credit histories to qualify borrowers. Yes Credit Karma is a legitimate free website that provides you with your credit score and report.

3102021 The total amount repayable will be 676764. Many lenders use the FICO score but even the score you receive through myFICO may be different from what your lender sees. Heres what you need to.

1100 Broadway STE 1800 Oakland CA 94607 Credit Karma Offers Inc. So does Credit Karma prepare you for the loan application process. 1132021 Even if most lenders use a FICO score instead of the VantageScore 30 provided by Credit Karma they still offer a useful service.

From there you will be able to speak with. NMLS ID 1628077 Licenses. Some banks and other mortgage lenders rely solely on the TransUnion credit report which may use the Credit Vision Risk Score and others use both reporting agencies.

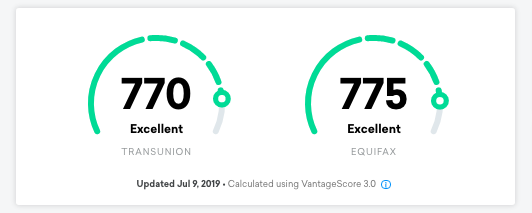

5202019 A lot of consumers are utilizing Credit Karma and assuming that the score they get from them is their universal credit score for homes cars and credit cards. But they can all generate a FICO score. Figuring Out the FICO Mortgage lenders check your FICO score -- a number between 300 and 850 -- which each of the three major consumer reporting agencies or bureaus generate.

Which credit agencies do mortgage lenders use. Yes they provide a free credit score that comes directly from the information and formulas furnished by the three credit bureaus. Experian TransUnion and Equifax.

11272018 Auto homeowners and renters insurance services offered through Credit Karma Insurance Services LLC dba Karma Insurance Services LLC. CA resident license 0172748. But if a borrowers score is in the ballpark the underwriter will usually request all three of their FICO scores from the credit bureaus she added.

Even if you arent applying for a credit card banks could still check your credit report if youre opening up a new account. Your APR will be determined based on your credit at the time of application. This could be because the account has an overdraft so theyll check to see how you manage your debts.

Credit brokers work with different lenders to provide offers to people who are looking for credit. 12122019 Lenders analyze your entire credit report and choose one representative credit score to decide the loan details. 2282020 Or more specifically Credit Karma is a deep funnel exclusive lead machine.

Whats the catch with Credit Karma. Successful applicants must be able to show at least one year of. Although the site positions itself as a trusted adviser it is motivated to sign.

As a lender most leads you buy are still standard top-funnel non-exclusive leads. Be prepared for mortgage lenders to take a good long look at your credit history. Your lender also might also use a proprietary credit score thats developed for use by just that company.

612020 A credit card issuer or an auto lender will generally only check one of your credit reports and scores when you apply for financing. Only mortgage activity by Credit Karma Mortgage LLC dba Credit Karma is licensed by the State of New York. A mortgage lender on the other hand will review your credit information from all three of the primary credit reporting agencies.

Mortgage lenders will look at these credit. As the name suggests lenders do the actual lending and the contract for any credit products you might find through Credit Karma is made between you and the lender offering the product you choose. 11272017 Which credit agency do banks use.

However they tend to use certain versions. Once they find their true mortgage credit score they are appalled and assume that Credit Karma has different information than what the loan officer pulled.

How To View Your Credit Report And Credit Score For Free Credit Score Check Credit Score What Is Credit Score

What Is Credit Karma And How Does It Work Are Credit Karma S Scores Accurate And Useful See What You Need Credit Karma Real Estate Articles Real Estate Tips

Credit Karma App How To Download And Use It Credit Karma

Credit Karma What Is It And How Does It Work Including Video Credit Karma Mortgage Companies Real Estate Tips

How Accurate Is Credit Karma We Tested It Lendedu

Credit Karma Assisting Home Owners Adn Ews

How To Increase Your Credit Score To 800 Good Credit Credit Karma Credit Repair

Tidak ada komentar