Scores from Experian you have options for a fee or even free. And you can view refreshed Equifax credit score.

Credit Karma Myfico Forums 5381041

VantageScore was created in collaboration with all three credit bureaus and VantageScore 30 is relied on by lenders across a variety of industries.

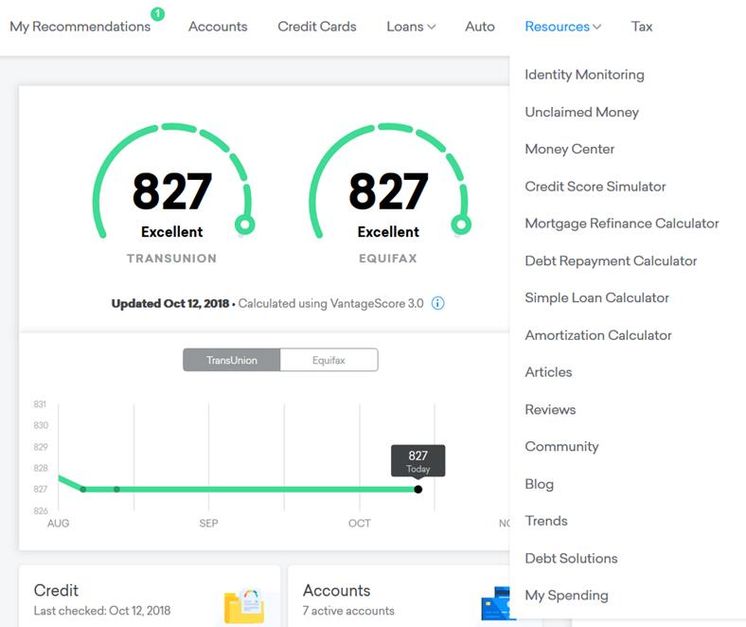

Can i see my fico score on credit karma. 192018 CK is now using the Vantage Score. 10242019 There are many different scoring models On Credit Karma youll see scores and reports from TransUnion and Equifax both using the VantageScore 30 scoring model. 792020 Credit Karma does not provide FICO scores or Experian credit reports.

The credit report information is accurate though. Though Credit Karma does not currently offer FICO. The credit score you see on.

Credit scores from Equifax and TransUnion on Credit Karma. VantageScores might trend higher than FICO. FICO officially the Fair Isaac Corporation is a credit-scoring company whose eponymous scores are the.

Credit Karma compiles its own VantageScore based on that. Its really free and you dont need to put in your credit card number or remember to cancel your free trial. If you plan on applying for credit.

Mortage lenders use a different scoring module. 10242019 On Credit Karma you can view refreshed TransUnion credit score and report information daily. Your credit score is 800.

Even prior to this change they were fako scores using their own module. But if you want to get your FICO. Also be aware that Credit Karma does not provide FICO scores they provide Vantage Score.

4122021 Credit Karma provides free credit monitoring through daily or weekly updates to your VantageScore which isnt the same as your FICO score. Is Credit Karma your FICO score. Itself charges 1995 a month for you to see those scores though they also throw in full copies of your credit reports which the free bank scores do not.

222021 Credit Karma uses VantageScore 30 for the information it provides to its users a company spokesperson said. They arent true Fico scores. 182020 Yes Credit Karma is a legitimate free website that provides you with your credit score and report no strings attached.

Score from all three credit bureaus depending on which banks hold your accounts. 382020 The good news is you can now see your real free FICO. Its important to keep in mind that no one credit score is the end-all be-all.

3102021 You can get your free VantageScore 30. 262016 Like WalletHub Credit Karma is an independent website that among many other features gives users free access to their Vantage 30 credit score. 30 on Credit Karma will likely be different from your FICO Score that lenders often use.

Thats nothing new but it appears the internet at large just found out. The scores and credit report information on Credit Karma come from TransUnion and Equifax two of the three major credit bureaus. And as usual Twitter users have the best response.

Scores the scores you see on Credit Karma VantageScore 30 credit scores from TransUnion and Equifax provide valuable insight into your financial health. 1272021 The score that most lenders see is your FICO score which is calculated differently and often costs money to access. All Americans have the right to a free credit report every 12 months.

They clearly state the scores are for educational purposes only.

/GettyImages-1041512942-69d44b3432c342469fb14e34e370f6bc.jpg)