Credit Karma pulled up your VantageScore. There are three major credit bureaus which means there are three versions of your report.

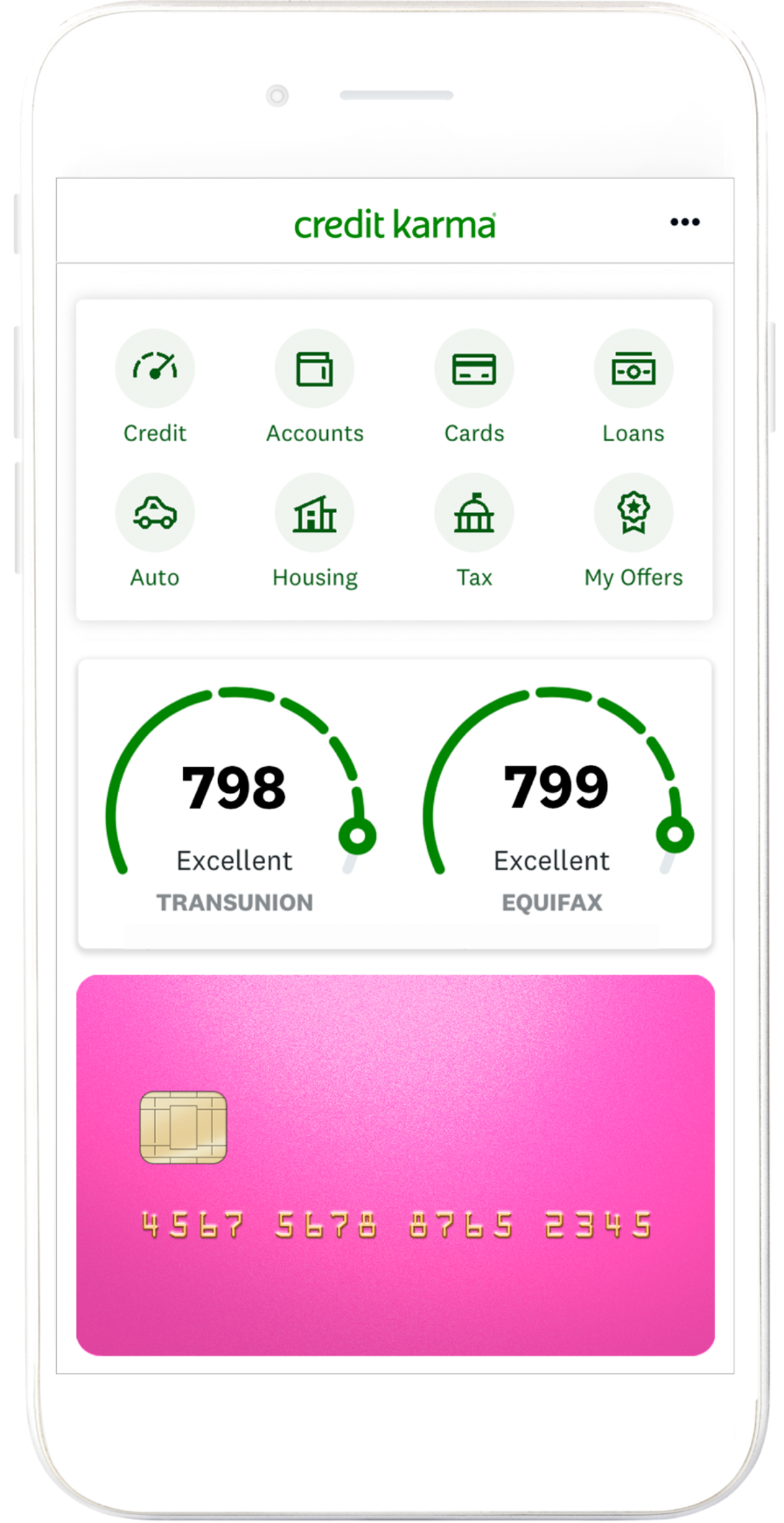

Credit Karma Review Get Your Free Credit Score Pt Money

The mortgage FICO scores are much more strict than the credit card and auto FICO scores.

Why is fico lower than credit karma. The reason being is a 1000 credit card is much less risk than a 200000 mortgage. If you read the fine print on the page where you get your score youll usually find this information. 222021 Thats because both FICO and VantageScore rely on consumer data from the credit bureau to produce their scores.

262016 There is no way to accurately convert credit scores from the VantageScore 30 model to any FICO score model. You get 25 years of experience and a score that evolves to meet your needs. Looks like CK is more balance utilization sensitive.

Also why do credit karma and capital one credit tracker show my debt paid off and my fico does. The other scores are not used in any lending transactions so they cant be compared. An EX FICO 08 score may be different than a TU FICO 08 score or an EQ FICO 08 score since they are using data from 3 different CRAs.

Also like FICO the VantageScore uses the same range from 300 to 850 to gauge a. Credit Karma Shows You Your VantageScore Not Your FICO Score. For perspective the card was 66 utilization and total aggregate was 104 utilization I already paid it off.

I put a large charge on my Discover card and my FICO 8 dropped 20 points Fico 2 dropped 30 pts. FICO defines the following credit ranges based on FICO. Scores are widely used by many types of creditors including lenders credit card issuers and insurance providers to gauge your credit risk that is how likely you are to repay the money loaned to you.

If you are getting your scores from Credit Karma those are TU VS 30 and EQ VS 30 scores. 9262020 There are two common reasons why the information in your copy of your credit report might be different from the information in your lenders copy. Just checked Credit Karma and it dropped 67 POINTS.

FICO is the most well-known and widely used scoring model as 90 of major lenders rely on those scores when evaluating applicants. VantageScore data could be slightly higher than others as it doesnt generate industry-specific scores only base scores. 5122014 My score was 3 points lower than my mortgage FICO score from TU so these scores can be accurate.

Auto FICO scores are now going up to 1000 while mortgage FICO. Plus data may have been updated in the time between you pulled your report and when your lender pulled it. Here are the most common reasons.

Their specifics are corporate secrets and their differences arent consistent from person to personWhats more some of FICOs industry-specific scores actually use a different scale 250 to 900 than most credit scores. 1302020 Torres says people who already have low scores are most likely to see their scores go even lower and that will worsen inequities in the credit system. Credit Karma only uses Trans Union data so it does not take into consideration Experian or Equifax data which can be different.

Only one of Credit Karmas scores are used in lending and it is an old version. 1272021 Then there are credit scoring firms which take the data collected by credit bureaus and apply their own algorithm to come up with a score for each one. The higher your credit scores the more likely youll end up with better rates and terms on your loan.

When a lender runs your credit theyll usually see your three FICO scores from. ALL scores FICO 08 VS 30 etc are going to be generated using the data held by one of the CRAs. If you plan on applying for credit.

On the flip side non-FICO credit scores can lead you to underestimate your creditworthiness keeping you from purchasing a much-needed family car or refinancing a mortgage that could save you thousands in interest. 4132021 Depending on what your scores are you may wonder what they mean. The way we use credit has changed a lot since the first FICO Score.

As CNBC explains Consumers tweeted about going to apply for a credit card or loan thinking they have good or excellent credit only to soon find that the credit score that the card issuer or lender pulled was lower than what they saw on Credit Karma Here is what is going on here. 12122018 So why would your bank score be lower than Credit Karmas. Where are you getting your FICO.

5202019 The reason is most credit cards are using a FICO 8 credit score which is typically 60 points or higher than a traditional mortgage FICO. This obviously stands to create some. Score 8 credit scores.

30 on Credit Karma will likely be different from your FICO Score that lenders often use. 792020 Credit Karma offers full credit reports from TransUnion and Equifax updated weekly. You cannot get your FICO scores via Credit Karma.

11102019 Why is my FICO score lower than my credit score on credit karma. Heres why your Credit Karma score might be higher. 4122021 Credit Karma which provides free credit monitoring gives different scores than FICO.

212021 In the case of Credit Karma it makes use of the VantageScore.

/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Credit Karma Just How Accurate Are The Scores

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

How Credit History Impacts Your Credit Scores Credit Karma

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

Tumblr Credit Score Credit Karma Good Credit Score

Why Is My Credit Karma Score Higher Than My Fico Score

/creditkarma-59a4800eaf5d3a001134a684.jpg)

The 5 Best Free Credit Score Apps

Tidak ada komentar