Store credit cards only use soft pulls during the pre-approval process. 1252021 Anytime you check your own credit its a soft pull.

Credit Report Cards Credit Com Vs Credit Karma

132021 Checking your credit through a service such as Credit Karma for example results in a soft pull.

Does credit karma show soft pulls. Soft inquiries arent an indicator of greater risk and thus dont impact your credit scores. One of your current creditors checks your credit. You check your own credit.

Other times a soft pull happens when you check your own credit score. To be specific the credit score payment history public records and warning messages are the exact same on a customers hard pull as they are on a soft credit check through iSoftpull. How to Do a Soft Credit Check.

A hard pull on the other hand can affect your score. Theyre purely informational and dont impact your credit score at all. 5302019 By contrast a soft inquiry may occur if someone checks your credit report but you didnt submit a new application for credit.

Does Credit Karma Hurt Your Credit. Soft inquiries may still appear on your credit report depending on the bureau. Soft pulls do not affect your credit score.

A bank pulled my credit file and assured me it was only a soft inquiry but I see it listed on my CreditKarma profile. Its in the same location as the hard inquiries so Im not sure how to tell what it is. For example a soft inquiry occurs when.

These can be done by lenders for things like pre-approvals but they are probably most commonly done when you check your credit score using something like Credit Karma or other times when something like a background check is done on you. While opening new credit accounts results in a hard pull looking at pre-qualified offers generally only requires a soft pull. 5222020 Soft pulls also occur when you review your info via a credit monitoring service.

Card issuers or other. Soft pulls have no effect on your credit score and lenders. You can check your VantageScore 30 credit scores from two major credit bureaus Equifax and TransUnion for free at Credit Karma as often as you like without affecting your credit scores.

When you access your information on Credit Karma it counts as a soft. Try this site where you can find the best solutions for all your personal financial needs. Soft inquiries dont show on your credit report for your future creditors consideration.

When you receive a pre-approved offer for a store credit card it is because the issuer used a soft pull to do a preliminary check of your credit and determined that you were likely to be approved. When youre shopping around for a mortgage its not uncommon for you to speak with multiple lenders. 12212020 There is no such thing as a soft pull store credit card.

I only use it for monitoring my accounts pulls new accts etc. Im only asking because im curious. Why Is My Credit Karma Score Different From My FICO Score.

All Scores 760 Newest goal 800. The thing is that CK only gives the Transunion and Equifax scores and not Experian so why did Credit Karma soft pull my Experian report. When you check your credit score on Credit Karma it counts as a soft inquiry that is not sent to the credit bureaus.

Credit Karma provides a score based on the older version of Vantage meaning a range of 501-990. You also see soft inquiries when you pull your own credit. Now that we know more about Credit Karmas free scores it is time to answer the question.

And if either of these two things have happened they are categorized as soft pulls and will not chip away at your score. Name and Address Only. A pre-qualification soft pull delivers the exact same credit data as a hard pull the only difference being its a soft pull.

This is reported as a soft credit check so it wont lower your scores. 12122019 Hard inquiries appear every time you apply for credit. 12122018 The first 2 versions use a score range of 501-990 and the newest Vantage 30 has a range of 300-850.

Examples of hard credit inquiries and soft credit inquiries. This leads to much confusion. No using Credit Karma doesnt hurt your credit.

Additionally when insurance companies request a credit check in order to give you a quote that will usually also result in a soft pull. Does CreditKarma show soft pulls. Creditandfinancesolutioninfoindexhtmlsrcperfinance RELATED repost.

Soft credit checks arent associated with applications for credit so you wont get a credit decision with it. I know soft pulls dont hurt my score. But I pay no attention to the score.

12102020 Will Credit Karma hurt your credit. The answer is no. Inquiry that isnt reported to the.

Soft inquiries occur when your existing creditors pull your credit during account reviews or for preapproval offers. EQ FICO 819 TU08 778 EX 806 lender pull 07262013. I use CreditKarma also.

Only hard inquiries such as a lenders credit check when you apply for a mortgage get reported. 1132021 Many people ask if getting your credit score from Credit Karma will damage your credit.

See My New Video I Made Today How To Get Credit Karma Credit Card Limit

Credit Report Cards Credit Com Vs Credit Karma

Credit Report Cards Credit Com Vs Credit Karma

How Self Affects Your Credit Report Self

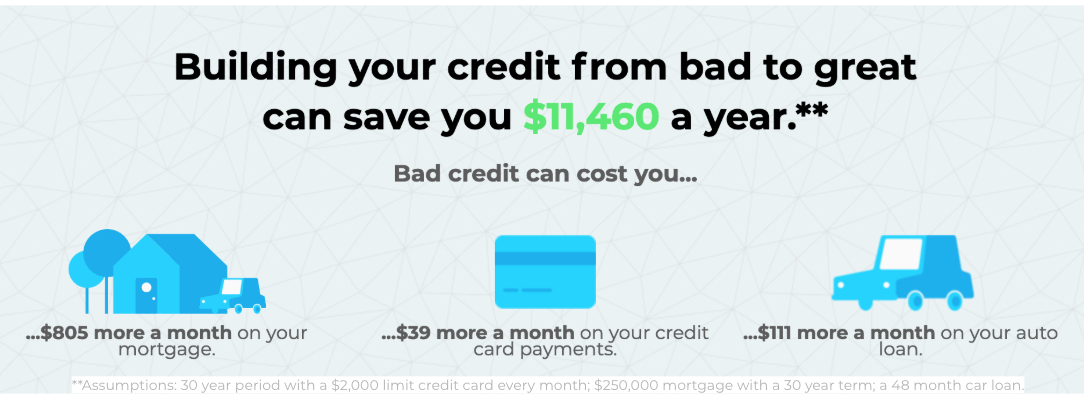

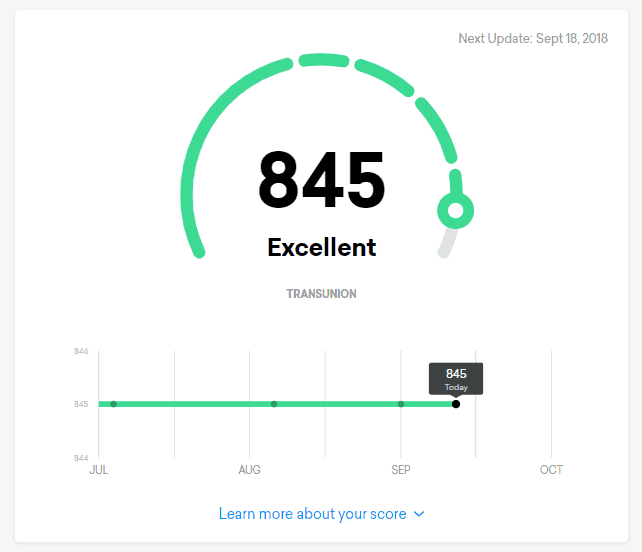

Credit Sesame Review Legit Free Credit Score Or Scam 2020

Credit Karma Canada Review 2021 Free Credit Score And Report

Credit Report Cards Credit Com Vs Credit Karma

Tidak ada komentar