VantageScore was created in collaboration with all three credit. Paid off in full every month have but never use od utilities on DD or paid off immediately have always been on electoral roll never had any CCJsIVAs lived at last 2.

North By Northside When Is Your Credit Score Not Your Credit Score

10232017 That said what likely reasons are there for me having a 999999 Experian score but only 487700 ClearScore Equifax score.

Why is my credit score different on experian and credit karma. Your Credit Karma score should be the same or close to your FICO score which is what any prospective lender probably will check. Most banks use FICO scores. Credit Karma does not provide FICO scores or Experian.

So why is your credit score different depending on the source. 222021 Why your Credit Karma score may be higher than your FICO score. 752019 As we mentioned before Credit Karma is a credit simulator that uses your Equifax credit score and your Transunion credit score to give you an idea of your credit status.

Three major credit. While it uses a different algorithm than FICO. 1202021 This is due to a variety of factors such as the many different credit score brands score variations and score generations in commercial use at any given time.

Here are some of the most common situations. On Credit Karma youll see scores and reports from TransUnion and Equifax both using the VantageScore 30 scoring model. 3102021 Its important to know your credit score and what a good credit score is because having a poor or fair Experian credit score could cost you lenders may be reluctant to give you a loan or approve you for a credit card or you may pay a higher interest rate than a borrower with a good credit score.

So if you have a collection account that appears on your TransUnion credit report but not on your Experian credit report then your TransUnion credit score might be lower. I have no debts credit card used regularly. 3202021 Each credit bureau calculates your credit score with the data in its credit file.

Credit Karma does not provide FICO scores they are of a different scoring model cslled Vantage 3. Its also possible the score the lender is using is based on all three of your credit reports. 1242020 There are a few reasons why you might get different credit scores from FICO and each of the three major credit-reporting agencies.

Credit scores can vary because of differences in the credit scoring algorithms that each reporting agency uses. Scores are from different dates. VantageScore was created by the three major credit bureaus Experian EXPN.

9262020 If the score you pulled is based on one credit report and the lenders is based on another there will be differences due to differences in data between the two reports. There are many different scoring models. There are many distinct credit scoring formulas used by creditors lenders and insurers to evaluate your creditworthiness.

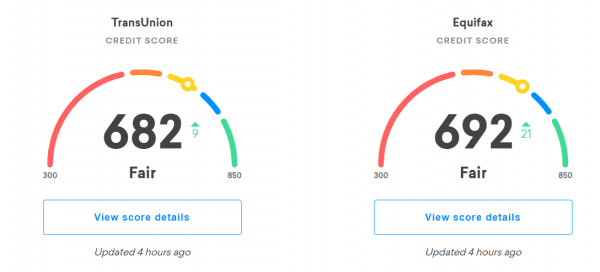

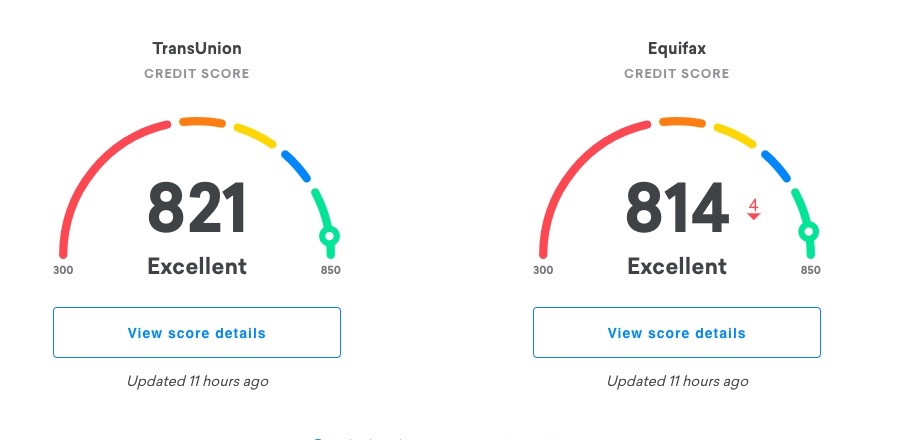

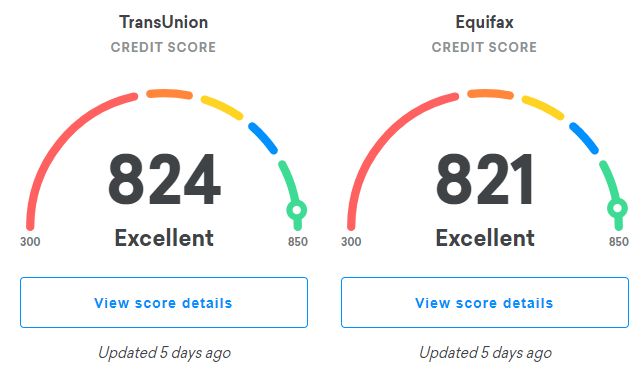

1272021 What Credit Karma says my credit score is vs what it actually is pic. Great chance you are comparing a score from Credit Karma with a range of 501-990 versus the score your bank is using with a range of 300-850. Your Transunion score will always be a little different from your Experian score.

Vantage and FICO differ greatly in how they weigh and respond to different aspects of your credit profile. 192019 A credit score is a three-digit number thats calculated by applying a mathematical algorithm to the information in one of your three credit reports which are generally updated each month. For example the nine-point difference between my two scores could stem from the fact that Equifax reports a slightly longer history and more accounts than TransUnion.

212021 As Credit Karma explains the chances of your credit score being the same on both models are highly unlikely. For example Experian calculates your credit score with the data in your Experian credit report. Here are three of the reasons why.

1262021 There are multiple reasons why your credit score differs between what a personal finance website tells you and what your credit card company or a prospective lender find. Some are more important than others depending on the situation. The majority of lenders use FICO - so while credit karma is great for monitoring and reviewing your reports their scores should be ignored.

Remember each of the three credit bureaus interprets your credit history a little differently. Generally the higher your credit score the more likely you are to receive favorable terms on a loan like lower interest rates and higher dollar limits. These scores are not provided by Credit Karma.

Lenders dont always report to the three major consumer credit-reporting agencies. 10242019 Whether its a different score from a bank an auto lender or another source its not unusual to see many different credit scores. 792020 Experian offers free access to credit scores and credit reports through various free product suites as well as paid score and report options.

12122018 Credit Karma only uses Trans Union data so it does not take into consideration Experian or Equifax data which can be different. That can translate to significant money. This is mainly because of.

9192019 Why is my score different depending on where I look. These factors are likely to yield different credit scores even if your credit reports are identical across the three credit bureauswhich is also unusual. 212019 There are three key reasons your scores may be different from one credit bureau to another.

As mentioned above your credit score may vary slightly depending on the credit agency it comes from and the scoring algorithm used. Heres a closer look at where credit scores come from how theyre calculated and which one you should care about. Since your scores might change at any time its important to compare credit scores from the same date.