It shows the credit score each bureau reports for you plus what each includes on your credit report. When my balances were all 0 across the board 2-3 weeks ago my Vantage scores all went up while FICO went down.

Beginner S Guide Check Your Credit Score With Credit Karma 5 24 Number Monkey Miles

1222010 Since all credit-scoring companies have slightly different models and use different inputs and formulas to determine your score this can cause variations in credit scores.

/GettyImages-1041512942-69d44b3432c342469fb14e34e370f6bc.jpg)

Why is my credit score different than credit karma. FICO officially the Fair Isaac Corporation is a credit-scoring company whose eponymous. One Twitter user compared Credit Karma to the enabling. Lenders dont always report to the three major consumer credit-reporting agencies.

8142017 Looking beyond cosmetics the first difference youll see between the apps is Credit Karma gives you access to reports from two credit reporting bureaus. For perspective the card was 66 utilization and total aggregate was 104 utilization I already paid it off. The mortgage FICO.

Vantage and FICO differ greatly in how they weigh and respond to different aspects of your credit profile. Here are three of the reasons why. 9262020 If the score you pulled is based on one credit report and the lenders is based on another there will be differences due to differences in data between the two reports.

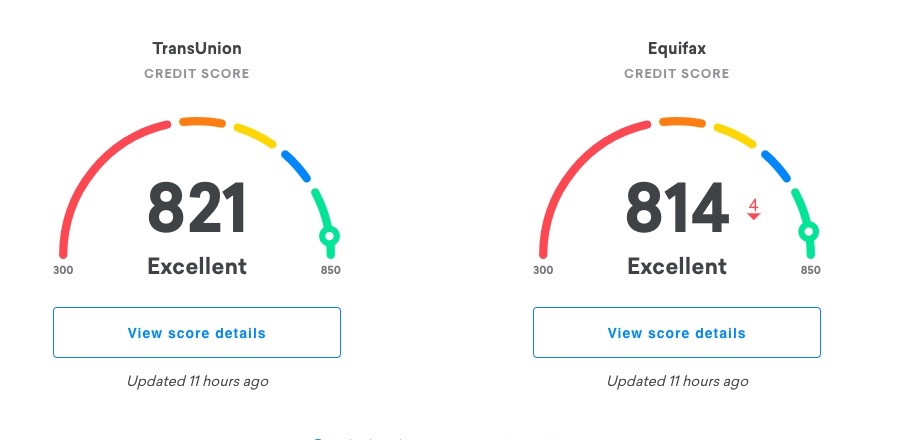

Most banks use FICO scores. On Credit Karma youll see scores and reports from TransUnion and Equifax both using the VantageScore 30 scoring model. And if you opt for credit monitoring Credit Karma will also send you alerts when there are important changes to your credit reports which may help you spot potential errors or fraud.

792020 Credit Karma is a free website that provides credit scores and reports to its members along with financial articles and advice. Looks like CK is more balance utilization sensitive. Credit Karma does not provide FICO scores they are of a different scoring model cslled Vantage 3.

Great chance you are comparing a score from Credit Karma with a range of 501-990 versus the score your bank is using with a range of 300-850. Finally the dealer could have been using an industry option score which is a credit score based primarily on your past auto finance history. Using a service like this can give you tools to help.

Credit Karma and FICO are two completely different types of companies. Joined Sep 10 2014 Messages 4513 Reactions 23140 533 184 Alleybux 126797 Diamond649 said. 4212021 The score you see online at any of the free credit report sites is likely different than the score lenders request and receive to evaluate your creditworthiness.

1242020 Scores are calculated using different credit reports. The majority of lenders use FICO - so while credit karma is great for monitoring and reviewing your reports their scores should be ignored. 4132021 Credit Karma shows you the different credit factors that can affect your scores and where you can work to try to improve your credit.

Why is my FICO score on my credit card app say it is different than my mortgage FICO score. It then charges companies to serve you targeted advertisements. Credit karma is about 546.

There are good reasons for this. 4132016 two different score modelsalgorithms credit karma tends to be higher then myfico. Some lenders report to all three major credit agencies but others report to only one or two.

30 on Credit Karma will likely be different from your FICO Score that lenders often use. These scores are not provided by Credit Karma. If you plan on applying for credit.

Can anyone tell me why when I log into the discover app and check score its 582 but when I check through experian its 665. Credit Karma gives you a free credit score and credit report in exchange for information about your spending habits. 212021 As Credit Karma explains the chances of your credit score being the same on both models are highly unlikely.

Keep in mind that even though there are numerous versions of the Continued. Credit Sesame shows the same but only from TransUnion. 262016 John S Kiernan Managing EditorFeb 6 2016.

VantageScore was created in. 4122021 A higher credit score can mean a better interest rate on a home loan or auto loan which could save you a lot of money in the long run. A FICO score is used by the majority of lenders.

222021 Many of these tweets centered on a common theme that the credit scores Credit Karma INTU 046 presents are higher than what lenders see. This means a credit agency may be missing information that helps or hurts your score. The reason is most credit cards are using a FICO 8 credit score which is typically 60 points or higher than a traditional mortgage FICO.

We recommend you periodically check your credit reports for errors which could affect your scores. Ive been checking my score on credit karma constantly because Im finally at a financial place right now where I. 10242019 Whether its a different score from a bank an auto lender or another source its not unusual to see many different credit scores.

12122018 Credit Karma only uses Trans Union data so it does not take into consideration Experian or Equifax data which can be different. 1 1 55 minutes ago 14 t1gress. There are many different scoring models.

Everything on Credit Karma is free if you sign up for its. The reason being is a 1000 credit card is much less risk than a 200000 mortgage. Like WalletHub Credit Karma is an independent website that among many other features gives users free access to their Vantage 30 credit score.

5202019 Now comes a curveball. Its also possible the score the lender is using is based on all three of your credit reports.

How To Use Credit Karma To Get Real Credit Score For Free

Credit Karma Review Get Your Free Credit Score Pt Money

Credit Karma For Iphone Review Pcmag

Credit Karma Review 2021 Is It Accurate Safe Legitimate

/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Credit Karma Just How Accurate Are The Scores

What Key Factors Impact My Credit Score

Credit Karma Beware Scoreology

Tidak ada komentar