This is why Wheres my Amended Return comes in handy. How long will refunds take for EITC and ACTC filers.

4 Strategies For Getting Maximum Roi From Your Tax Season Emails

1 Remember you can file back taxes with the IRS at any time but if you want to claim a refund for one of those years you should file within three years.

How long does it take to get your taxes back from credit karma. 1292020 It can take up to 16 weeks to process an amended return and issue any related refund the IRS said. As long as you filed your return or extension on or before April 18 and you selected April 18 or earlier as your payment date you wont get penalized for late payment. Of course filling out a 1040-EZ takes about 10 minutes and isnt at all complicated so it wasnt worth much.

Keep in mind that some circumstances can delay a refund. 1252021 The IRS says nine out of 10 taxpayers will receive their refund within 21 days of filing if they do so electronically using direct deposit and. The sooner you file the sooner you could get any refund youre owed.

Your 21 day average starts from this point - so you can usually expect your tax refund the last week of February or first week of March. Again Credit Karma doesnt make this decision the IRS does. 4142021 If you are due a refund for withholding or estimated taxes you must file your return to claim it within 3 years of the return due date.

3102021 According to the IRS taxpayers who mail in their returns but choose direct deposit of their refund will generally receive their refund in about three weeks. Then it may take up to a few additional days for your bank to make the funds available to you. The IRS sends over 9 out of 10 refunds to taxpayers in less than three weeks.

12172020 If you e-filed your return you can normally expect your refund about 21 days after filing. Unfortunately a 21-day delivery of your tax refund isnt guaranteed. 10252019 If you have the Earned Income Tax Credit or Additional Child Tax Credit your refund does not start processing until February 15.

612019 Mailed paper returns Refund processing time is 6 to 8 weeks from the date the IRS receives your tax return. However some tax situations will take more time to process so if your taxes are a bit more complicated than the average persons you may wind up having to wait longer. If you want to stay in good standing with the IRS you should file back taxes within six years.

If you mailed a paper return it can take six weeks or more for the IRS to issue a refund. Also remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail. According to Credit Karma they support a pretty wide range of tax returns so lets start with what forms Credit Karma does no t support when using Credit Karma taxes.

That means your bank will have your refund within three weeks from the day the IRS accepts your tax return. 1142020 Now that you know how to use Credit Karma Tax to take your return to the next level dont wait until the last minute to file your taxes. 3312021 Usually the IRS says to allow 4 weeks before checking the status of your refund and that refund processing can take 6 to 8 weeks from the date the IRS receives your return.

You cannot do your taxes on CreditKarma if you. The same rule applies to a right to claim tax credits such as the Earned Income Credit. It takes about six weeks for the IRS to process accurately completed back tax returns.

How long will my tax refund take. If your 2020 tax return includes one of the credits below you could experience delays in. 4162021 Even though we issue most refunds in less than 21 days its possible your refund may take longer.

262021 How long Credit Karma takes for a tax refund Credit Karma explains that if you e-filed your tax return your refund should arrive about 21 days. We hold income tax refunds in cases where our records show that one or more income tax returns are past due. 1212021 For 2020 taxes the majority of taxpayers who choose this option will receive their refunds within 21 days.

Those who e-file their returns but choose to receive a paper check in the mail will generally receive their refunds in. 152021 Generally it can take up to 16 weeks from the day the IRS receives your amended return for it to be processed and it may take 3 weeks from the day you mailed it for it to show up in the IRS system. 4292020 According to the Credit Karma website you could receive your refund in as little as 21 days.

In the meantime keep an eye on your bank account if you still dont see the debit 7-10 days after your return has been accepted call IRS e-file Payment Services at 1-888-353-4537 or contact your.

Credit Karma Tax The Consumer Credit Site Trusted By 60 Million Users Launches Its New Completely Free Tax Filing Service Cardrates Com

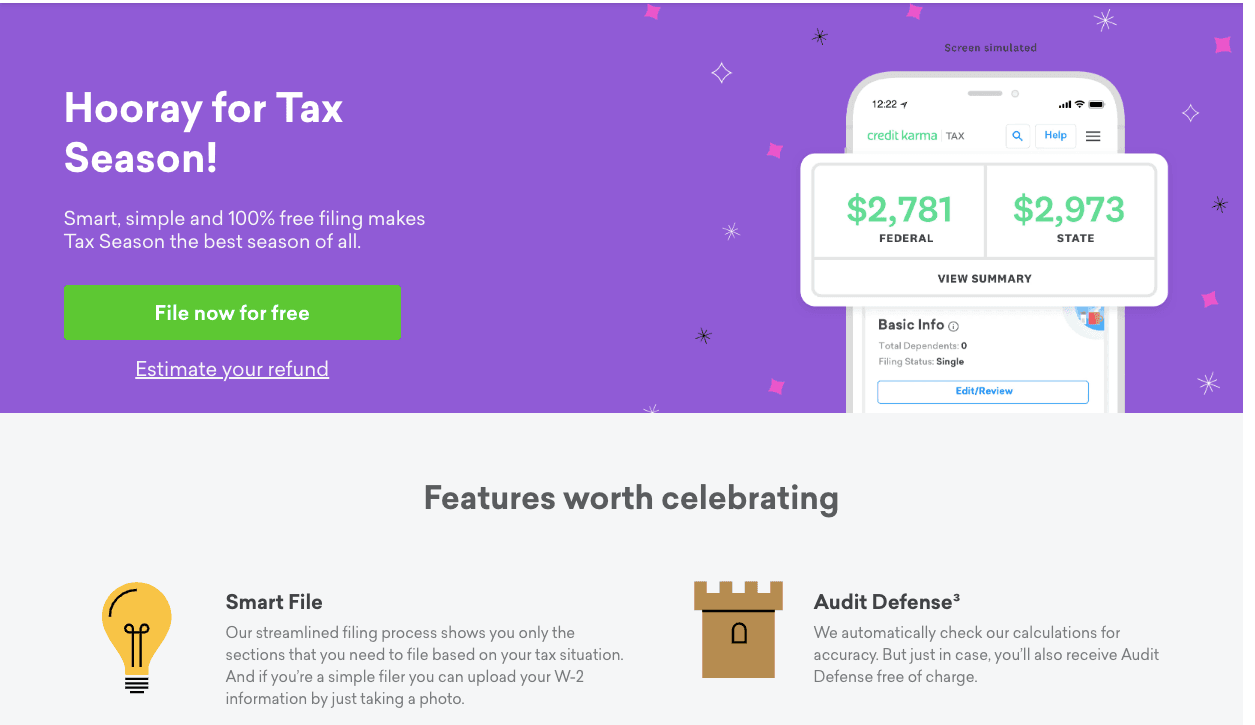

Free Tax Return Prepare File Taxes Online Credit Karma Tax Filing Taxes Credit Karma Free Tax Filing

Credit Karma Tax Review My Experience Using Credit Karma Tax

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

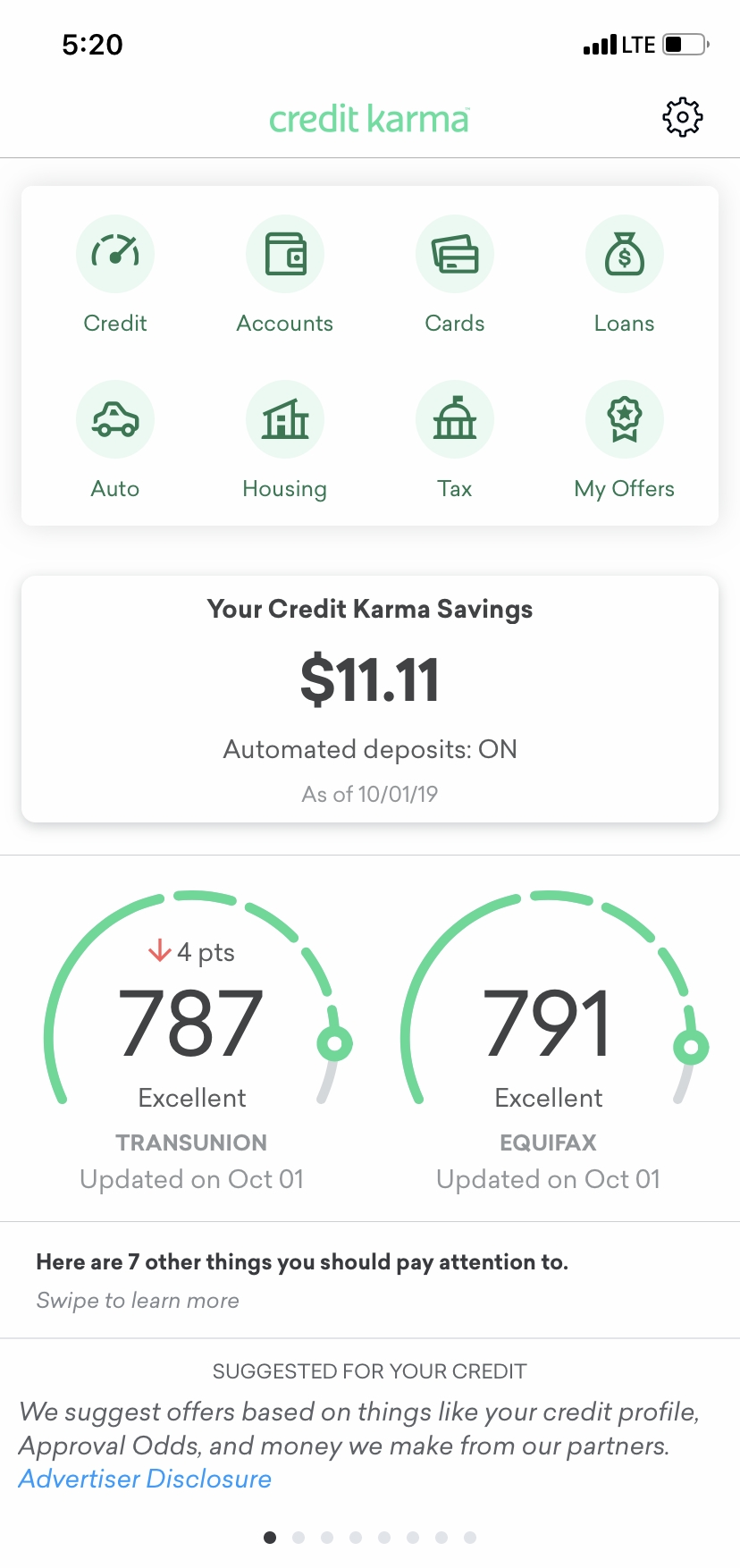

Credit Karma For Android Review Pcmag

Credit Karma Simplifies Savings With High Yield Accounts1 In As Easy As Four Clicks To Get Started Business Wire

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Tidak ada komentar