NMLS ID 1628077 Licenses. 20072021 Credit Karma LLC.

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

9212020 The total amount repayable will be 676764.

Credit karma amend tax return 2020. I was very fortunate. Account to get my student loan tax info last night as my final loan out of an original 12 was paid off in May of 2020. CREDIT KARMA OFFERS INC.

W-2 Wages and Tax Statement. If you e-filed with Credit Karma Tax in prior years you can view download or print a copy of your prior-year returns after accessing this years tax product. It appeals to those enticed by the word free and can handle a.

Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023. If taxpayers discover a mistake on their tax return this is not necessarily cause for concern. In order to make changes corrections or add information to an income tax return that has been filed and accepted by the IRS or State Tax Agency you must file a tax amendment to correct your federal or state tax return.

Is a registered trademark of Credit Karma LLC. For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. Electronically filed return for Tax Year 2019 or Tax Year 2020.

2262021 Once youre on the tax site Credit Karma Tax asks the same things all personal tax websites do. This site may be compensated through third party advertisers. Only Tax Year 2019 and 2020 1040 and 1040-SR returns can be amended electronically at this time.

Change my return CMR is a secure My Account service that allows you to make an online adjustment for the 10 previous calendar years. You must wait to receive your Notice of Assessment before making any changes to your tax return. There is now a 25 minimum.

Oct 22 2020 Last Updated. This number is increasing because tax preparation software like Credit Karma Tax and TurboTax 2020 are reducing the barriers to self-prepared returns. Free Tax Returns New Features For 2020 Max refund guarantee has been increased to a maximum of 100.

Individual Income Tax Return. Your APR will be determined based on your credit at the time of application. Terms and conditions may vary and are subject to change without notice.

I then saw that 8 of my 12 original loans all of which had been listed as PAID IN FULL and had been listed as 0 dollars balance some of which for. Product name logo brands and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. First you will need to access Credit Karma Tax for the current year.

A surprise 1099 came up for 2017 which had been filed with turbotax requiring me to amend my 2017 return. IRS Tax Tip 2020-145 October 29 2020. A tax return where 9 reassessments exist for a particular tax year.

1122021 Nearly 50 of all Americans prepare and file their own taxes each year. 3292021 The IRS says dont file an amended tax return if the new Covid bill changed your refund The new Covid relief package waives taxes on up to 10200 of unemployment benefits per individual in 2020. You must file your Federal return with Credit Karma Tax before you can file your state return with us.

Amended Returns for any other tax years or tax types must be filed by paper. Your marital and dependent status and your 2020 income and expenses like self-employment income. A tax return that has not been assessed.

Credit Karma - amended tax return 1040X and state tax return. Filing your Federal tax return without filing a state tax return. Credit Karma Tax 2020 remains a reasonable free option for filing federal and state taxes.

NMLS ID 1628077 Licenses. If you and your spouse if youre married filing jointly lived and earned income in only one state for the entire tax year. 1100 Broadway STE 1800 Oakland CA 94607 Credit Karma Offers Inc.

There must be a record of an original. Your APR will be determined based on your credit at the time of application. Here are some common reasons people may need to file an amended return.

I normally file with turbotax but tried Credit Karma because an update trubotax was waiting on prevented me from submitting my completed return for 2018. You cannot use Change my return to change. Amendments can be made for 10 previous years so if you are filing this years 2020 you can only amend back to 2010.

CREDIT KARMA OFFERS INC. 9172020 First and foremost if you need to amend your tax return do not file another return for that year. 652019 Dont waste your time.

Most errors can be fixed by filing a Form 1040-X Amended US. If you are entitled to an education credit it should be the same on Turbo that it is on CK. 12272020 The total amount repayable will be 676764.

Federal tax situations forms and schedules we support. You file your amended return with all the things you missed or forgot. Amended Returns must be filed by paper for the following reasons.

If you try to file a second return it will be rejected no matter who you file it through. 1100 Broadway STE 1800 Oakland CA 94607 Credit Karma Offers Inc. A return prior to the year of bankruptcy.

2152021 You dont keep filing multiple returns.

Best Tax Software For 2021 Turbotax H R Block Jackson Hewitt And More Compared Cnet

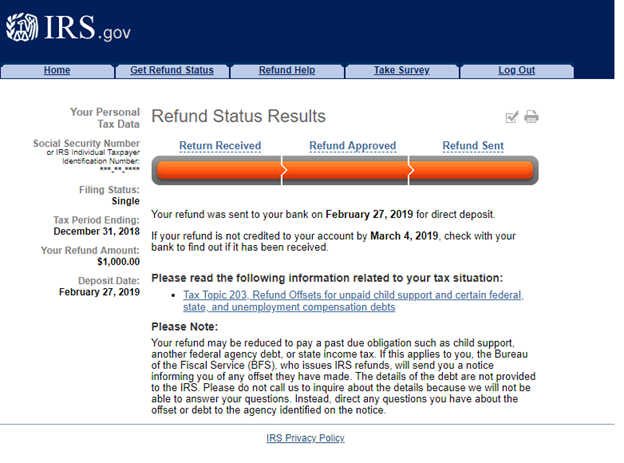

Why Was The Refund Amount Deposited To My Account Different From The Irs Where S My Refund Link Support

Was The Tax Year 2019 Tax Deadline Delayed What To Know About Coronavirus Covid 19 And Your Taxes The Turbotax Blog

Sanlam Business Risk Management Review 2020 Business Risk Risk Management Management

Credit Karma Tax Vs H R Block Which Is Better For Filing Taxes

Credit Karma Tax Creditkarmatax Twitter

American Opportunity Tax Credit H R Block

Tidak ada komentar