When you dispute an item on your report the credit bureau must investigate it within 30 days 45 in some cases. This process carries numerous complexities but these are the basic first steps.

Credit Reports How Often Does Your Credit Score Update

10242019 I made a payment why am I not seeing it on Credit Karma.

Credit karma dispute longer than 30 days. Well show you how to dispute anything thats not right. After you send a Direct Dispute to TransUnion youll be able to check on the status of your dispute in your Dispute Center. The credit bureau must also report the results back to you within five days of completing its investigation.

On average TransUnion typically responds to a dispute within 30 days. The requirment under the FCRA is that they conclude their reinvestigation within 30 days but that is kinda transparent to the consumer. Credit disputes can take a few weeks or months depending on how the process goes for you.

If they do not respond within this time frame they must remove the negative listing disputed. TransUnion typically completes its investigation within 30. These are two separate disputes.

Credit Karma doesnt exactly know when creditors will update your credit information. 11132020 The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. If you have written a credit dispute letter to a credit bureau disputing the accuracy of an account they have 30 days to investigate the account.

And if it does not you can sue the credit reporting agency. If you have multiple lenders they might report at different times of the month. When looking at your debts it gives you the option to dispute any of them.

What happens if a credit dispute passes 30 days. Well continually monitor your credit report for you. If they cannot verify the information within 30 days they must either delete the information or advise you that it is still under investigation.

732018 Once you file your re-dispute the credit bureaus have another 30 days to do an investigation on the new information. 1152020 According to the FTC the three major credit bureaus must investigate the disputed items unless they consider your dispute frivolous and the investigation is usually within 30 days after you dispute an item. See all your accounts in one place.

382017 My Credit Karma Review. 8142019 It might take up to 30 days or even more in some cases for creditors to report new payment activities or balances to credit bureaus. You should wait it out however as a follow up before the time limit is up could be thrown out as spam.

Get alerts whenever theres something new. You may learn the results of the investigation more quickly if you file a dispute online and opt to receive an email notification. Learn whats holding your score back.

Within 30 DAYS of receiving notice of the debt from the debt collector you can send a letter to the debt collector disputing the debt and requesting the name and contact information of the original creditor. 232021 Once you submit the form TransUnion will review the disputegenerally within 30 daysand notify you about any resulting changes to your credit. There are a number of ways through which you might dispute errors on your credit reports.

See your TransUnion credit score. Weve made your score clear and transparent. I used the Credit Karma app on Android.

Once the investigation is completed the bureau must also provide you with an update to let you know the results of your dispute. You fill out a few questions and they submit the dispute. Its my understanding that a lot of creditors wont even respond to the dispute and if thats the case the dispute will he successful and the credit bureau will delete it.

Its worth noting that Credit Karma was recently purchased by. Ever since I first used Credit Karma in my 10 free financial services post and yes you can get a free Credit Karma account for life Ive had many curious friends and readers ask me questions about themThat prompted me to write this Credit Karma review and update it frequently. RIGHT TO DISPUTE THE DEBT.

They gave me the result for the first dispute but they havent closed the investigation on the second dispute. According to federal credit law spelled out in the Fair Credit Reporting Act FCRA a credit bureau is required to respond to you and complete their investigation within 30 days. During that time the dispute is reviewed verified with the relevant data furnisher and if applicable the necessary corrections are made Blumberg says.

1192016 Disputes are typically handled by the credit reporting agencies in a timely manner. Besides that the frequency of their updates can vary as well. They have an additional 5 buiness days thereafter which can become up to 8 calendar days with an intervening weekend and holiday in which to send their Notice of Results of Reinvestigation.

132007 yes there is not if ands or buts it must come off if creditor has not reponded in 30 days. As you can see there is no direct answer as to how long a credit dispute takes as it varies on a case-by-case basis. Usually lenders report any new balances payment activity credit limit changes and other updates to the credit bureaus every 30 days but different lenders may update at different frequencies.

4112018 Under the Fair Credit Reporting Act the bureaus have 30 days to resolve your dispute There are some exceptions such as if you just received your free yearly credit report which allow for 45 days but 30 days is the most typical timeframe. 3252017 If its been 30 days after youve sent in your dispute the credit bureau is in hot water. You could send a fax to the credit bureaus or give them a call.

Well show you what you can do to improve it. Its been 3 months and i still havent received a second response to my second dispute. 4142020 Credit bureaus are required to investigate your claim and provide a response within 30 to 45 days.

10242019 What to expect after filing a Direct Dispute through Credit Karma. The thing is Credit Karma shows its still under investigation and that they have 30 days to respond.

Here S How Long It Takes To Improve Your Credit Score

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

How To Remove Late Payments From Your Credit Reports

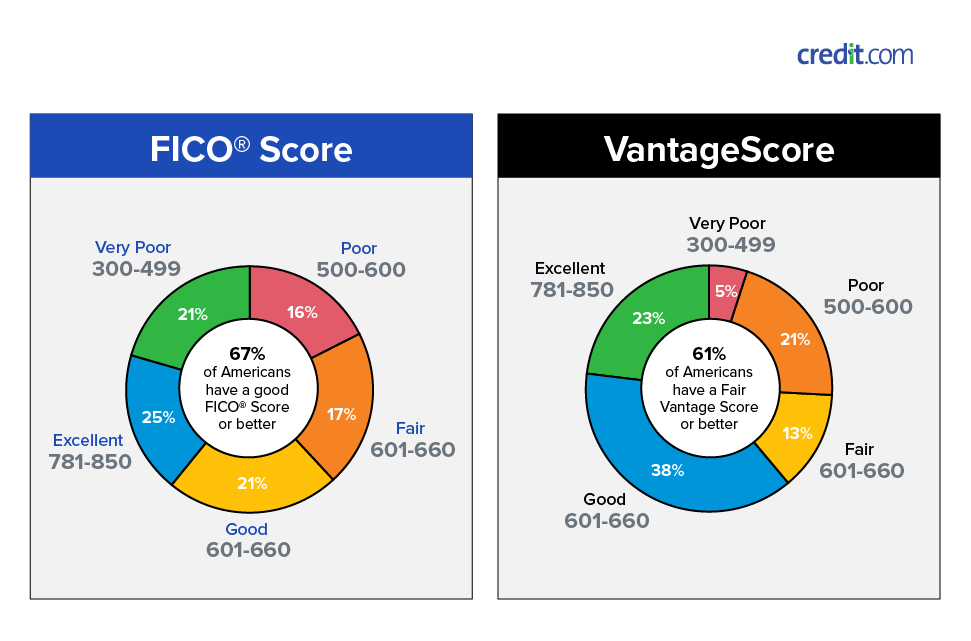

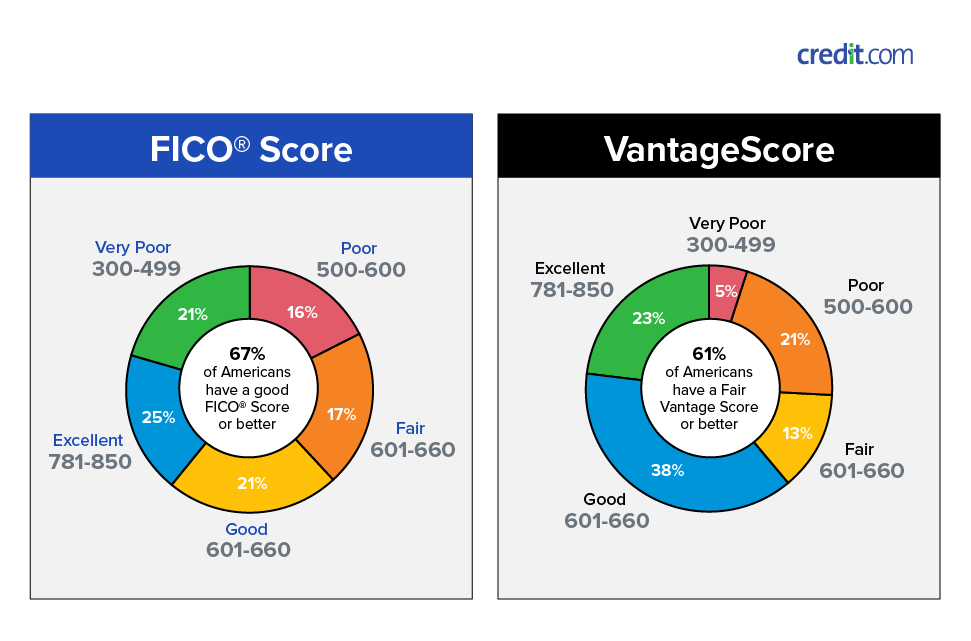

What Is A Good Credit Score Credit Com

The Best Things To Charge On Your Credit Card When You Re Rebuilding Rebuilding Credit Credit Repair How To Fix Credit

What S A Credit Report And How Do You Read One

Credit Cleanup Tools Home Of The Credit Cleanup Newsletter Credit Removal Demand Letter Exc Lettering How To Remove Creditors

Tidak ada komentar