Line 8 Enter the letter identifying Origin of the Policy. If you and your spouse if youre married filing jointly lived and earned income in only one state for the entire tax year.

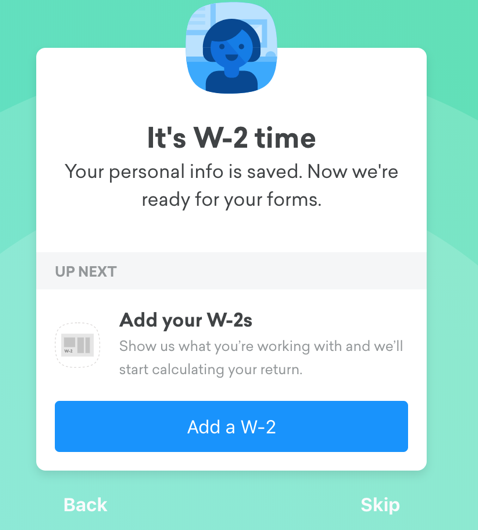

1095 Tax Form And Health Insurance Premiums Credit Karma Tax

File a final Form 1099-B for the year the short sale is closed as described above but.

How to add 1095-b on credit karma. Leave the other numbered boxes blank. Form 1095-A Line 33 Column C. Search for 1095-A and select the Jump to link at the top of the search results.

Entering Part I Responsible Individual Policy Holder. Product name logo brands and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. 662019 You do not have to enter a 1095-C in TurboTax.

The insurance company will provide the IRS with the needed information. The 1095-B form is sent to individuals who had health insurance coverage for themselves andor their family members that is not reported on Form 1095-A or 1095-C. Box through the post office your childs Form 1095-B will not be delivered.

For individuals enrolled in qualified health plans in different states add together the amounts from column B of the Forms 1095-A from each state and enter the total on Form 8962 line 11 column b. Please add your child or children to your PO. If you have an employer-sponsored health insurance policy Part II will list the name of your employer and your companys address.

You wont be able to take the Premium Tax Credit without it. Form 1095-B provides information about your health coverage. 282019 You really dont need to do anything with the Forms 1095-B and 1095-C except keep them with your records for tax year 2018.

You must file your Federal return with Credit Karma Tax before you can file your state return with us. Government agencies such as Medicare or CHIP. After you have e-filed your Federal return with Credit Karma Tax.

1222020 As your 2019 tax documents start arriving in January 2020 you should receive a 1099-G from your state showing a refund of 50 from 2018. February 17 2020 830 AM. 5252019 Unlike the 1095-B and 1095-C you need to enter this form.

In box 1a enter a brief description of the transaction for example 5000 short sale of 100 shares of ABC stock not closed. Part I identifies the person whose name is on the insurance policy. 792020 Form 1095-B and Form 1095-C help the IRS know whos entitled to tax credits to help pay health insurance premiums.

Insurance companies outside the Marketplace. While HMSA isnt required to send Form 1095-B to CHIP subscribers well send you a form if you subscribe to the HMSA Childrens Plan which is a different plan. 322021 Information about Form 1095-B Health Coverage including recent updates related forms and instructions on how to file.

In Part III youll see your insurance providers name and address. This amount will be taxable income on your 2019 return. ACA Form 1095-B - An Overview - Updated October 29 2020 - 800 AM by Admin ACAwise.

The form has four parts. Federal tax situations forms and schedules we support. However if you claimed the standard deduction on your 2018 return that 50 refund would not be taxable income.

For an employer-sponsored plan for example this would be the name of the employee. The 1095-B is sent by the Health Care Providers such as. Provided the coverage is responsible for sending you Form 1095-B.

1262019 Type 1095-B and click Create new copy. The form will tell you whether your gain or loss was short-term or long-term. When the Affordable Care Act ACA was passed the IRS designed Section 6055 of the Internal Revenue Code as a way to gather information on the health.

312016 In Part I of Form 1095-B youll find your personal information including your name address and Social Security number. Form 1095-B is used by providers of minimum essential health coverage to file returns reporting information for. For a detailed list of other types of members who wont receive a form visit irsgov.

This is an important distinction because short-term gains are taxed at ordinary income rates while long-term gains are taxed at more favorable rates of 0 15 or 20 as of tax year 2020 depending on your overall taxable income. Heres how to enter your 1095-A in TurboTax. If you have coverage through an employer you typically wont qualify for the advanced premium tax credits that would help you buy a.

3232021 If you use a PO. This site may be compensated through third party advertisers. Enter the Issuer or Other Coverage Provider Name and click Create.

How to fill out Form 8962 Step by Step - Premium Tax Credit PTC Sample Example Completed - YouTube. If you know. Information for Line 1 2 3 4 5 6 and 7 will be completed by the program.

Box at your local post office or update your mailing address with Medi-Cal by contacting your county human services agency. Part II identifies the employer if your coverage is employer-sponsored. Check if Form 1095-B is for the Taxpayer or Spouse.

Open continue your return if you dont already have it open. Box and your child is not listed on your PO. You will answer the question in the Health Insurance section that you had health insurance all year and keep a copy of the 1095-C with your tax records.

Forms And Situations Credit Karma Tax Supports

1095 Tax Form And Health Insurance Premiums Credit Karma Tax

Irs 1095 C Codes Explained Integrity Data

Credit Karma Loans Review 2019 Apr Fees Eligibility And More

Credit Karma Loans Review 2019 Apr Fees Eligibility And More

1095 Tax Form And Health Insurance Premiums Credit Karma Tax

Tidak ada komentar