For example auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan. 12232019 I thought getting pre-qualified for a mortgage would be simple but it was a huge pain until I found Credit Karma Liz Knueven 2019-12-23T141500Z.

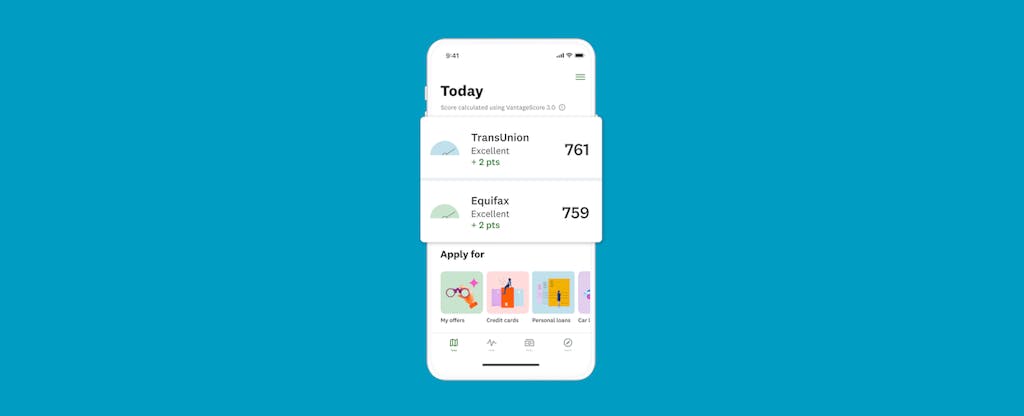

Credit Karma Get A Free Credit Score And So Much More In 2020 Credit Karma Free Credit Score Online Taxes

5202019 The reason is most credit cards are using a FICO 8 credit score which is typically 60 points or higher than a traditional mortgage FICO.

Credit karma says i may have a mortgage loan. So that is DEFINITELY not me. The mortgage FICO scores are much more strict than the credit card and auto FICO scores. Your FICO score determines which type of mortgage loan youre eligible for or whether you qualify at all.

9262020 Creditors and lenders use more specific industry credit scores customized for the type of credit product youre applying for. The reason being is a 1000 credit card is much less risk than a 200000 mortgage. For example you could receive a loan of 6000 with an interest rate of 799 and a 500 origination fee of.

3192021 What is the Best Way to Use Credit Karma. Credit Karma thinks I have a mortgage that I dont know about. It is an online financial platform that makes credit bureaus information available to.

After more poking around the site says Your credit file indicates you may have a mortgage loan opened in or around 2012. Who is the credit provider for this account. 3102021 Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender.

Our goal is to make the loan process smooth and transparent for our clients. Credit Karma shows you offers from lenders we partner with but we are not a lender. 792020 Credit Karma.

4 Which of the following is your middle or former name. Happens every single time for me. Have a mortgage loan and it says that to everyone.

Like the title says I just checked my credit score on credit karma and when it was trying to clarify my identity it asked me about a mortgage loan started in 2016 which records indicated I had. 4212011 It says this. Mortgage Karma has helped individuals and families from several walks of life to achieve their dreams of responsible home ownership.

However if theres an issue our system will ask for the full nine digits. Try entering your full SSN Social Security Number During your first attempt at signing up well only ask for the last four digits of your SSN. 3 On which of the following streets have you lived.

10242019 You can search for loan offers with your Credit Karma account and sort by annual percentage rate loan amount or monthly payment. With Credit Karma you can get a general idea for your score. Mortgage lenders use a score developed specifically for mortgage loans.

You may need to click to navigate to each text box to enter all nine digits. If a person does not have a mortgage loan then it says that the person may. 2122021 Since your score represents your trustworthiness to lenders youre likely to get a good deal on a loan the better it is and that means paying less money for your mortgage.

As previously mentioned Credit Karma is not a credit bureau. If you choose to apply for a personal loan you found on Credit Karma youll be taken directly to the lenders website to continue the application process. Its very common for the questions to ask questions where the answer is NA.

Have a mortgage loan. But nothing is an exact science and you cant rely solely on Credit Karmas credit scores to determine how likely you are to get approved for a loan. 1Your credit file indicates you may have a mortgage loan opened in or around June 2006.

3102021 Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender. Credit scores range from 300 to 850 and are often crucial to the homebuying process. 5112015 It says that you may.

Being a wholesale mortgage broker we are able to work advantageously with the lenders that we deal with and therefore greatly. If it is really low for example there is no reason to expect your FICO score will. But it is a free tool and it can still be useful in the following ways.

Credit Karma does not tell you what your FICO score is and you should not rely on it to gauge the score a lender will check when you apply for a mortgage. 2What is the total monthly payment for the above-referenced account. For example you could receive a loan of 6000 with an interest rate of 799 and a 500 origination fee of.

1132021 If youre looking for a free reliable credit monitoring service Credit Karma provides real-time updates and personalized advice to help you raise your credit score. And once it has your personal information you can search for personalized offers for a credit card a car loan or a home loan and your search wont pop up in your credit report on Credit Karma.

What Is Credit Karma And How Does It Work Are Credit Karma S Scores Accurate And Useful See What You Need Credit Karma Real Estate Articles Real Estate Tips

Ultimate Home Buyers Checklist Save Time Money Mortgage Loans Mortgage Payoff Mortgage Process

Why Is My Credit Karma Score Lower Or Higher Than My Mortgage Lender The Home Mortgage Pro Blog Credit Karma Home Mortgage Mortgage Lenders

Credit Karma App How To Download And Use It Credit Karma

8 Reasons To Partake In Consumer Loans Handyman Tips Mortgage Loans Payday Loans Home Improvement Loans

Credit Karma Free Credit Reports It S A Good Idea To Identify The Debt In Your Name Credit History Includin Credit Karma Bad Credit Score How To Get Money

/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Credit Karma Just How Accurate Are The Scores

Tidak ada komentar