But a free Credit Karma account is necessary in order to use the service. 20072021 Credit Karma LLC.

Credit Karma Thin File Error Here S How I Fixed It Michael Saves

Try entering your full SSN Social Security Number During your first attempt at signing up well only ask for the last four digits of your SSN.

Why is credit karma not accepting state returns. Does not participate in the Free File Alliance. 2262021 Credit Karma Tax claims to support major IRS forms and schedules and indeed it does at no charge for either federal or state preparation and filing. 792020 In addition you can file your federal taxes and certain state returns for free via Credit Karma.

Other major websites to my knowledge wont let you file your state taxes with them unless you also file your federal return with them as well. Its always free to prepare and file federal and single-state income tax returns with Credit Karma Tax regardless of adjusted gross income. 4112021 4112021 At one point Credit Karma Tax was unable to accommodate claiming the Earned Income Tax Credit EITC for taxpayers without qualifying dependents but thats changed.

You can file your Federal return only or file your Federal return first and later file your state return but we dont support filing your state return without filing your Federal return first. 11192020 Credit Karma Tax which is included in Wisconsins list of approved vendors never charges you to file your single-state and federal tax returns. People filing a federal and state return such as Iowa where the most beneficial filing status filing status on federal is not the most beneficial status on the state should not use Credit Karma.

You may need to click to navigate to each text box to enter all nine digits. If youre using a VPN you may encounter some trouble accessing Credit Karma. 3222019 3222019 Credit Karma Tax is really free there is no charge for filing a federal or state return regardless of your income.

However if your Wisconsin filing status is married filing separately you wont be able to use Credit Karma Tax to file your Wisconsin state tax. However if theres an issue our system will ask for the full nine digits. You can qualify for the EITC without a dependent if youre 25 to 64 years old filing as single head of household or qualifying widower and if your income is less than 15820 for the 2020 tax.

752020 I have submitted my federal and CA state tax returns via credit karma on 01292017 and federal returns was accepted immediately after submission but ca state tax returns has not. Since we used Credit Karma to prepare our federal returns were basically stuck using them for the state return as well. 652019 I normally file with turbotax but tried Credit Karma because an update trubotax was waiting on prevented me from submitting my completed return for 2018.

Product name logo brands and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. That said its. Credit Karma makes money by offering financial products like credit cards to its.

At Credit Karma Tax you must successfully file a federal return before you can file a state return. 12172020 Credit Karma Tax. A surprise 1099 came up for 2017 which had been filed with turbotax requiring me to amend my 2017 return.

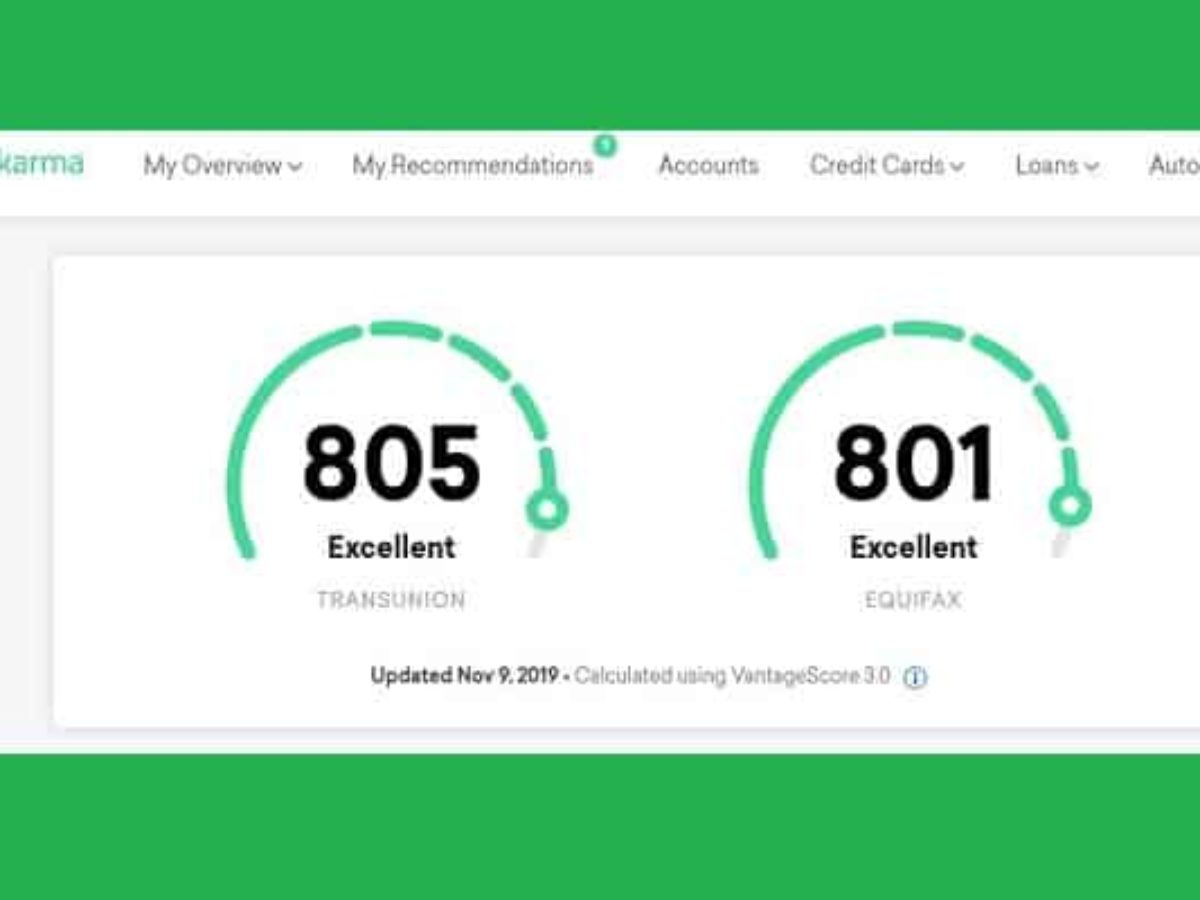

Founded in 2007 and based in San Francisco it now has over 800 employees across its three offices. Bottom Line Using their service to track and analyze your free credit score can be a big help when youre in the process of looking for a loan. 162021 All users can file state and Federal taxes for free.

Credit Karma Tax can handle a variety of tax situations beyond the most basic but not as many as TurboTax. This includes multi-state tax prep and some other unique situations. This site may be compensated through third party advertisers.

Not all state tax returns are available. Also Credit Karma is not currently available outside of the US. 1122021 1122021 Credit Karma Tax.

Is a registered trademark of Credit Karma LLC. Unfortunately Credit Karma Tax doesnt support every tax situation in 2021. Forms and situations Credit Karma Tax does not support.

1132021 The answer is no. The 0 price tag is a reason that Credit Karma Tax earns two top spots for Best Tax Software this year. Credit Karma Tax supports the most-common tax forms and schedules for Federal and state returns for tax year 2020.

Credit Karma is a personal finance company whose mission is to provide tools and education to help people make financial progress. You can check out the complete list of forms and situations we support. Everyone has the right to a free credit report every 12.

Standardized deduction and common itemized deductions are simple for Credit Karma Tax but once you get into business deductions even rental properties TurboTax is more equipped.

I Ve Been Lucky Enough To Have Some Incredibly Supportive Family And Friends But That S Not Always The Case Support Quotes Thoughts Quotes Inspirational Quotes

Chaosophia218 Chakra Jnana Yoga Chakra Yoga

Pin By Investopedia Blog On Finance Terms Economics Definition Forced Labor Interest Groups

Pin On Narcissistic Behavior Sucks To Be Treated Like Crap

A North Carolina Bill That Requires High Schools To Add A Personal Finance Course To Its Curriculum Has Recently Finance Class Personal Finance Finance Lessons

Post By Ms Ntlebi On Boldomatic 25th Quotes Inspirational Quotes Inspirational Words

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Tidak ada komentar