1272017 When a credit card account is closed the lender may add a statement to the account indicating whether it was closed by the cardholder or by the card issuer. An open account is an active loan of some sort that you are currently making payments on.

How To Read A Credit Report From Credit Karma Finivi

You might want to remove these accounts from your credit report as they can.

What do closed accounts mean on credit karma. Closed Accounts and Your Credit History. Closing a credit card can also shorten your average age of credit history. 10172019 I think you have a misunderstanding of what closed meant when your student loans disappeared from your credit reports.

A closed account on a credit report means you had a loan account that you or the lender closed. 6112018 Closed accounts or accounts that youve fully paid can stay on your credit report for up to 10 years. Closed accounts on your credit report means bad or good news to your credit score depending on whether theyre closed in good standing 0 balance or not.

12172018 The impact that a closed account has on your credit depends largely on the type of account involved and whether you still owe a balance. Your student loan debt is not actually gone as you seem to think. A credit account being reported as closed can shorten your age of credit history and may cause a drop to your credit scores.

Why your account is reported as closed. Updated April 02 2021 Your credit report includes a variety of information about your credit card accounts including the status of each account. Lets look at how this would affect your average age of accounts when looking at the two different models.

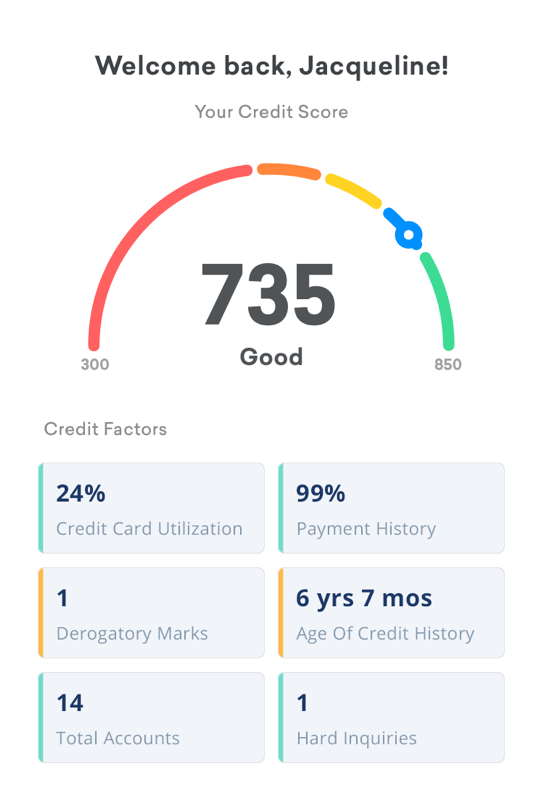

1152014 Closed accounts stay on your credit report for a period of up to ten years. March 31 2020 2 min read. 1232020 These include payment history credit utilization ratio length of credit history credit mix and types and recent credit.

They just dropped off your report due to the timing. Credit reports offer a great deal of other information besides your credit score. 12112020 The types of account information shown on your credit reports can include Open accounts.

While different lenders have different policies after a certain period of non-payment the original lender may write off a debt as a loss and sell it to a collection agency. 852016 If you have closed credit card accounts your credit report will indicate whether the account was closed by you or by the account issuer. On closed accounts your credit report may include a comment that indicates who closed the account and may say account closed by creditor.

And while credit scores continue to benefit from the positive history associated with an account for as long as it remains on the credit reportopen or closedonce the account is removed from your credit report all of that history is gone. With a credit card closing an account causes you to lose. A few months ago I was checking my credit report and my score has shot up over 100 points.

If the credit card issuer closed your account. Among the categories of information provided are open accounts. 10242019 A closed account can impact your credit scores depending on the scoring model and your credit situation.

Its my opinion that when FICO9 is released latest version of the FICO score that they will no longer include closed accounts in your average age of accounts. I looked through my report to see what had changed and I saw that my student loans accounts were all closed. A closed account is a loan that is no longer active ie.

Having a closed account on your credit reports could negatively affect your credit scores by increasing your credit utilization rate or decreasing the length of your credit history. A closed account in bad standing If you stop paying your debts after a period of time typically 6 month the lender usually closes the account for further payments writes it off and sell it to collection agencies or files a law suit. There are two different accounts.

For accounts closed with a balance the creditor continues updating account details with the credit bureaus each month. The accounts were not closed at least not in the sense that I think you mean. The first one is FEDLOAN SERVICING and the other is US DEPT OF EDUCATION.

The dates accounts were opened or closed. The statement Account Closed at Credit Grantors Request. The closed accounts that appear on your credit reports will disappear after either seven or 10 years depending on.

After the account is closed the account status on your credit report gets updated to show that the account has been closed. Simply means that the account was closed by the credit card issuer and it is not necessarily cause for concern. 4182019 Closed accounts in good standing are usually removed from the credit report within 10 years after closing.

10242019 Collections accounts can appear on your credit reports after a certain period of non-payment typically 180 days and can cause your credit scores to drop substantially. The history of a closed account remains on a report for.

Credit Karma App How To Download And Use It Credit Karma

Credit Karma For Android Review Pcmag

Credit Karma For Android Review Pcmag

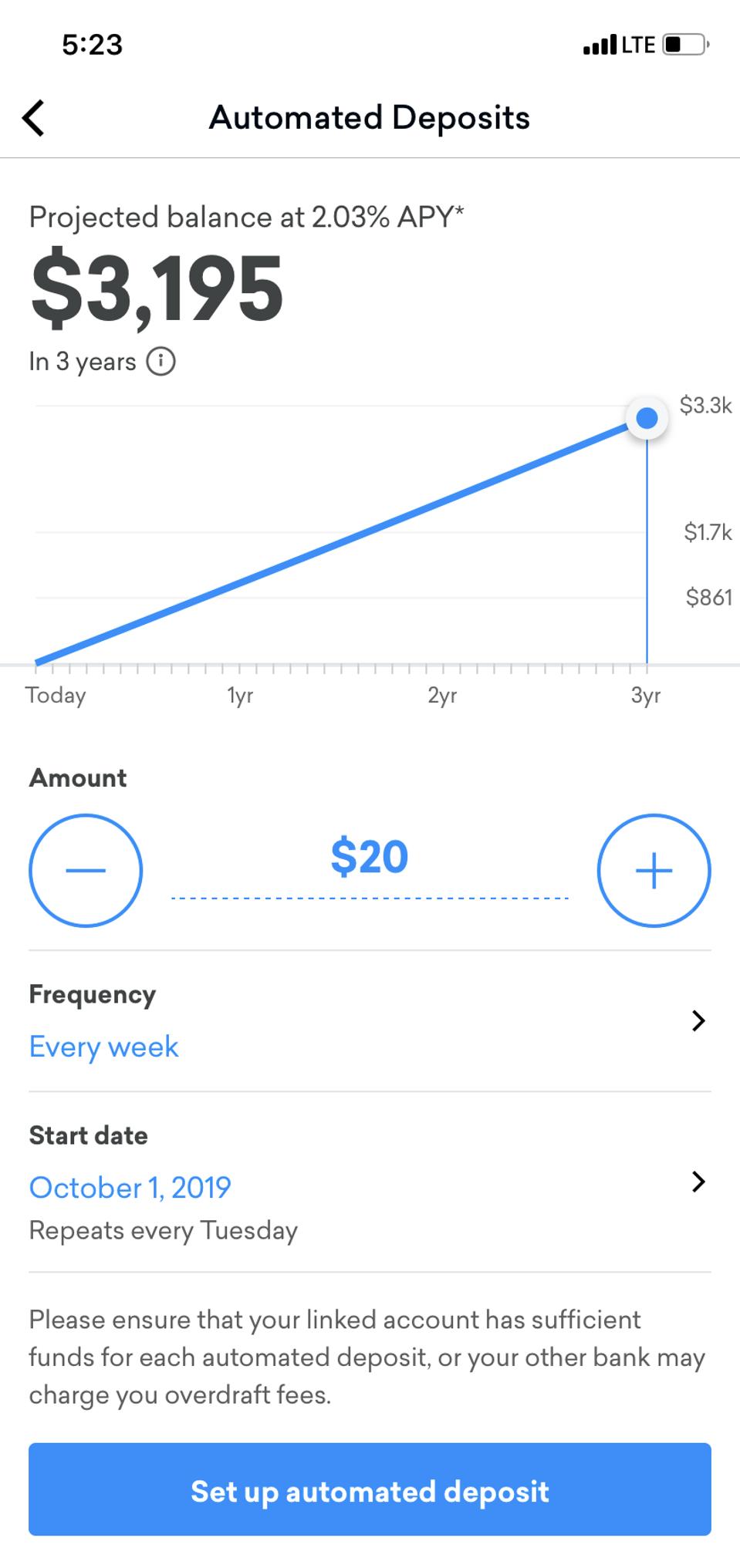

Credit Karma Launches High Yield Savings Account

How Do I View My Credit Rating Rating Walls

Free Credit Score Free Credit Reports With Monitoring Credit Karma Credit Karma Free Credit Score Credits

How Credit Karma Shows Your Free Credit Scores Credit Karma Youtube

Tidak ada komentar