731 Having a second card is probably going to help your score somewhat in the long run but it will also give you a hard inquiry and lower your average account age which will hurt it in the short term. Credit Karma currently has my credit score 50 points lower than the FICO score I get along with discover card statement.

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

However the information that was pulled by Credit Karma is the same that their mortgage loan officer pulledthe only difference is the algorithm being used.

Credit karma says i have a mortgage loan. The Mortgage Karma team is committed to providing clients with the highest quality financial services combined with the lowest rates available in your area. Have a mortgage loan. VantageScore was created in collaboration with all three credit.

Before applying for a loan review your credit reports to be sure the data on each of them is accurate. But nothing is an exact science and you cant rely solely on Credit Karmas credit scores to determine how likely you are to get approved for a loan. Vote Up Vote Down.

Credit Karma thinks I have a mortgage that I dont know about. 9262020 If youre applying for a mortgage the lender must provide you with a copy of the credit score used to qualify you for the loan. Like the title says I just checked my credit score on credit karma and when it was trying to clarify my identity it asked me about a mortgage loan started in 2016 which records indicated I had.

The changes noted were car loan paid and closed - 7500 but it also says the loan was removed. 10242019 Whether its a different score from a bank an auto lender or another source its not unusual to see many different credit scores. John asked 6 years ago.

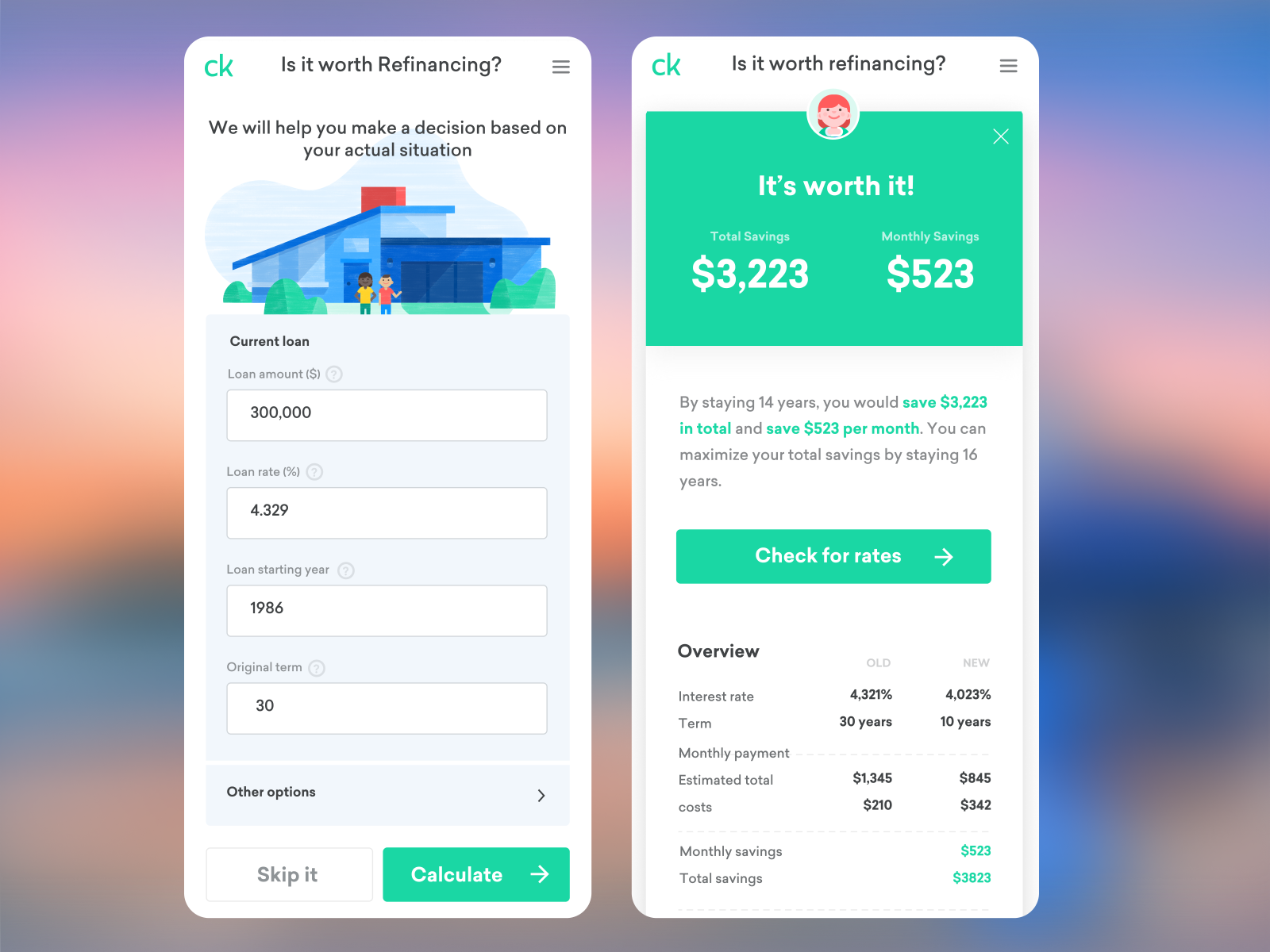

Have a mortgage loan and it says that to everyone. 12232019 I thought getting pre-qualified for a mortgage would be simple but it was a huge pain until I found Credit Karma Liz Knueven 2019-12-23T141500Z. If you choose to apply for a personal loan you found on Credit Karma youll be taken directly to the lenders website to continue the application process.

1132020 Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender. No delinquency on rental payments. In worse case scenarios this can even lead to a customer being turned down for a loan.

Successful applicants must be able to show at least one year of. When they go to apply for a mortgage or another type of loan they are then shocked when their score is not as high as they expected. For example you could receive a loan of 6000 with an interest rate of 799 and a 500 origination fee of.

1Your credit file indicates you may have a mortgage loan opened in or around June 2006. For example you could receive a loan of 6000 with an interest rate of 799 and a 500 origination fee of. Credit Karma can also help you research loan products.

4 Which of the following is your middle or former name. 2What is the total monthly payment for the above-referenced account. According to CK my TU score dropped 38 points and my EQ 27.

If youre in the market for a loan having a recent credit score and current credit offers in one place can be a valuable service. Based on the data Credit Karma compiles from your score and credit report it searches for credit cards that meet your profile and indicates your odds of approval. Remember that your credit score is based on your credit report.

Here are three of the reasons why. 5202019 Once they find their true mortgage credit score they are appalled and assume that Credit Karma has different information than what the loan officer pulled. 10242019 You can search for loan offers with your Credit Karma account and sort by annual percentage rate loan amount or monthly payment.

Whats the catch with Credit Karma. 3102021 Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender. 182020 Borrowers without a strong credit record often use FHA mortgages backed by the Federal Housing Administration.

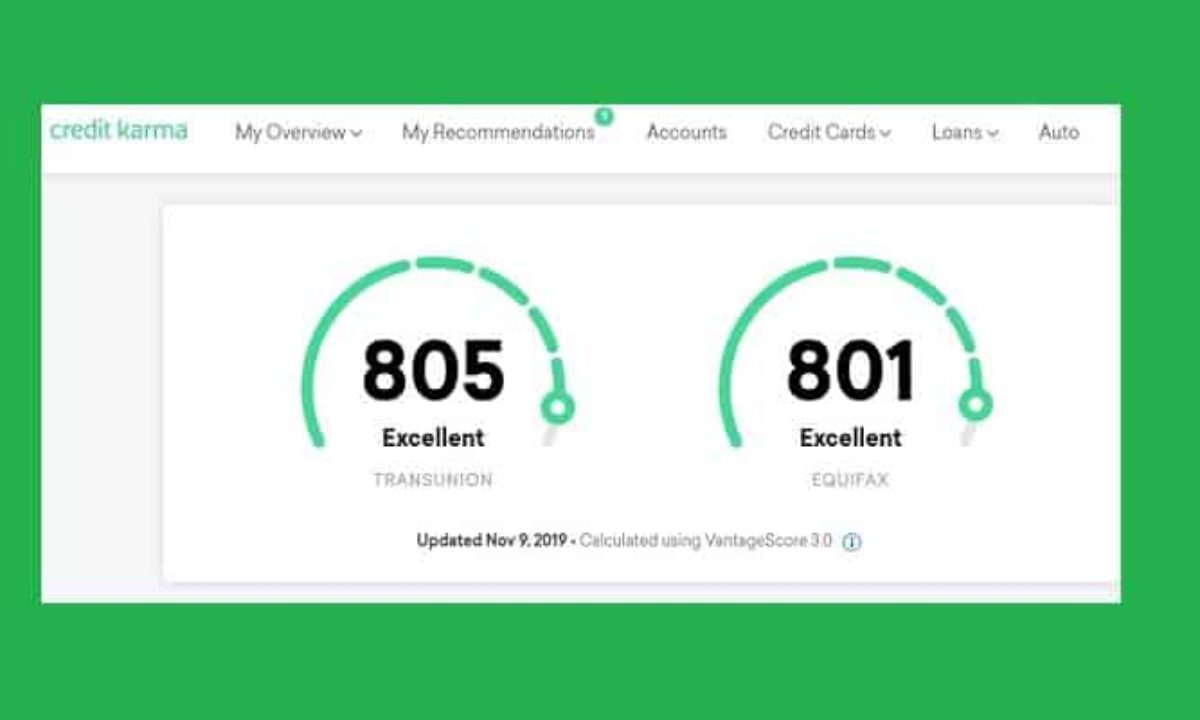

On Credit Karma youll see scores and reports from TransUnion and Equifax both using the VantageScore 30 scoring model. 3192021 A lot of our customers monitor their credit scores for free using Credit Karma. There are many different scoring models.

1132021 If youre looking for a free reliable credit monitoring service Credit Karma provides real-time updates and personalized advice to help you raise your credit score. 3 On which of the following streets have you lived. 4212011 It says this.

FHA loans allow lenders to use nontraditional credit histories to qualify borrowers. 5112015 It says that you may. Its common for lenders to ask for your bank account information during a personal loan.

Credit Karma shows you offers from lenders we partner with but we are not a lender. Who is the credit provider for this account. If a person does not have a mortgage loan then it says that the person may.

Questions Credit Karma says my score dropped for paying off a loan.

Credit Karma Thin File Error Here S How I Fixed It Michael Saves

Credit Karma Credit Report Finder Uk

Credit Karma Review 2020 Free Credit Reports For All Pros Cons

Credit Karma Home Mortgage By Shane Brown On Dribbble

Credit Karma Archives Finovate

Credit Karma Archives Finovate

Credit Karma Thin File Error Here S How I Fixed It Michael Saves

Tidak ada komentar