11152018 Its actually not a bad deal. Besides that the frequency of their updates can vary as well.

/creditkarma-59a4800eaf5d3a001134a684.jpg)

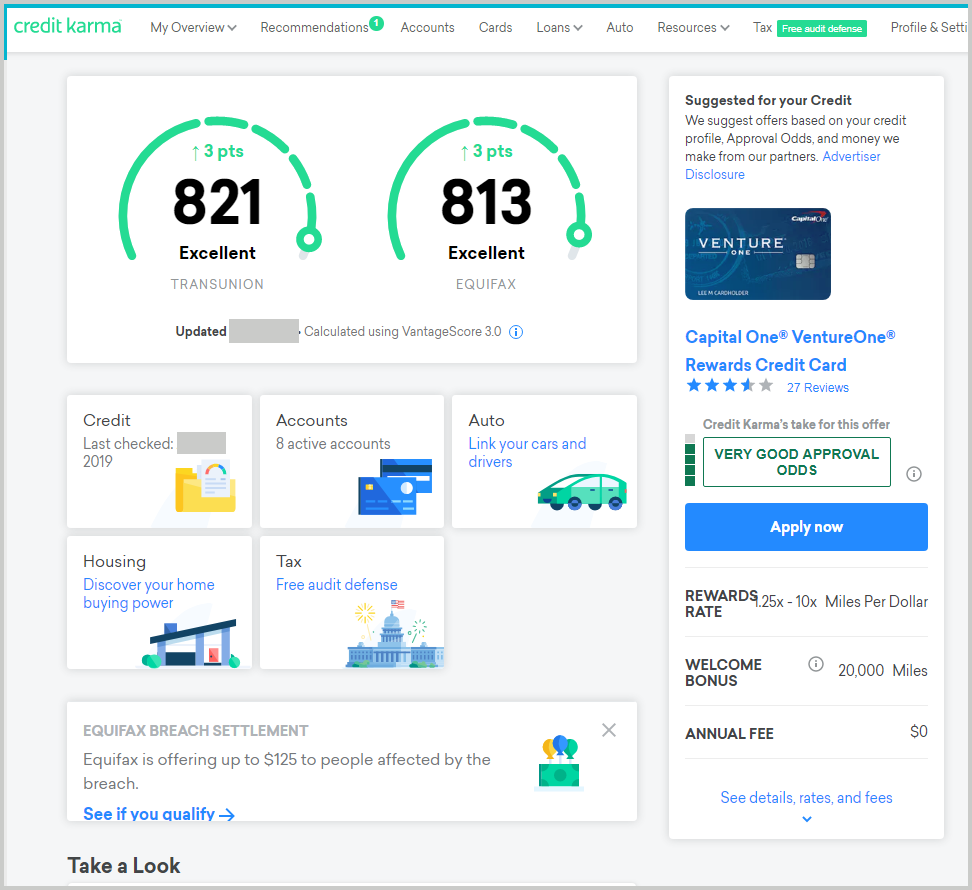

The 5 Best Free Credit Score Apps

Benefits of Capital One Business Credit Cards.

How often does capital one report to credit karma. 342021 Since your credit score is based on the contents of your credit report you want to make sure your reports are free from errors and any signs of fraud. In respect to this what time does credit karma update scores. Remember you can get a.

Capital one card not showing up in credit karma. 30 24 hours7 days a week. Paying down your balances will lower your utilization and youll see your score jump quite a bit.

Secondly how often do credit scores get updated. TransUnion Experian and Equifax. Chase has some of the most restrictive thanks to their 524 rule.

Capital One doesnt disclose exactly when they report to the major credit bureaus Experian Equifax and TransUnion but users in online forums seem to agree that Capital One information reaches your credit report a few. 1262021 Your score can then differ based on what bureau your credit repor t is pulled from since they dont all receive the same information about your credit accounts. Capital One Auto Finance completes a soft credit inquiry and then lets you know within minutes if you prequalify.

7152020 Unfortunately its a bit more complicated than that. Secondly different credit. Well its just not on credit karma but i havent checked my credit report ye but im pretty sure its not there eithershould i.

Credit Karma doesnt exactly know when creditors will update your credit information. From there you can use Auto Navigator to search for cars based on a. If you will need a car insurance HERE are the best deals from UpToMag discounts.

In your case that will be a month after it reports. 4162019 Capital Ones Auto Navigator is an online tool that makes it easy to apply for prequalification for a new or used auto loan and to search for vehicles within your budget all in one place. You sigh all files and save your cash.

Further they report from the opening less it stings as you will regain some points when your new card is three months old. Capital One usually reports to the credit bureaus 3 days after the closing statement. Capital One reports to the credit bureaus on a monthly basis usually on the monthly statement closing date or a few days after.

Provides your credit information to all three bureaus once per month. Credit card companies report information at least once a month. How to log-in and use Credit Wise If you are already a Capital One customer and you have a login ID then you can go ahead and use that information to login here.

1232020 Each bank has different credit card application rules. It would make sense to assume that your credit card activity is reported at the end of each billing cycle. If you need your balances to show 0 plan 3 days ahead of your closing statement.

Adding 5 or more new credit cards to your personal credit report in 24 months jeopardizes your approval odds for a new Chase credit card. Credit One Bank reports to all three credit bureaus each month to ensure card members always have the most up-to-date information reflected on their credit report. Exactly how does it operate.

I purposefully open new accounts around 29th or 30th that way the card is a month old after 2-3 days. Your credit rating. You Have to feel an easy application form with important information.

Typically it happens every 30 to 45 days. 12142020 It can be anywhere from quarterly to daily for an individual consumers information depending on the choices and practices of the lender or creditor she says. However according to Experian every lender reports to the bureaus following its own schedule.

Desired new expression. Unlike other credit card companies they do not immediately report a new balance of 0. At CreditWise you can access a free TransUnion credit report and a free VantageScore.

Responsible credit management will be reported to the bureaus and logged on your credit report which in turn can improve your score in the long run. Consumers have rights to a free credit report once a year from each of the three credit bureaus. You get accepted and see closing terms.

Most lenders and creditors ie. 8142019 It might take up to 30 days or even more in some cases for creditors to report new payment activities or balances to credit bureaus. 1212019 How often Capital One reports to credit bureaus According to Capital One it typically.

You can probably count on it happening at most once a month or at least every 45 days but the exact date varies by lender. Cap 1 reports every 30 days towards the end of the month 272829. The company doesnt specify the date.

How To Read A Credit Report From Credit Karma Finivi

How To Read A Credit Report From Credit Karma Finivi

Credit Sesame Vs Credit Karma Which Free Credit Monitoring Tool Should You Use

Printing A Credit Karma Credit Report Amerifund

Credit Karma Adds Equifax To Its Flagship Free Credit Monitoring Service

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Tidak ada komentar